Implications of Rising Energy II: $4/gallon gasoline and no relief in sight

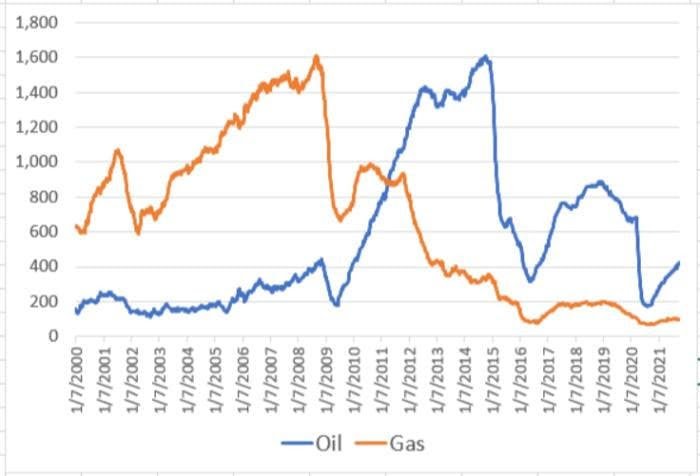

For context and some perspective, here are various global fossil fuels prices rebased to 100 and going back 6 months ago:

Two simple takeaways:

How incredibly broad based this is increase in energy prices has been. It isn't "just" UK or even Europe. Oil is up over 30% in 6 months, US natural gas and Chinese coal have doubled.

Relatively speaking, how wild what is happening in the UK and Asia has been. Those levels will destroy a lot of energy demand. People and companies will simply not be able to afford these prices.

With the strongly rebounding economy, you want to be be long this chart, somehow.

If you feel you are too late to go long energy or oil, you at least want to avoid the pain higher energy prices are causing.

Like what?

Like emerging markets (or companies) that earn one currency but must pay US dollars for their energy. $80 a barrel of oil is one thing for the US but what about when you convert that into very depressed Turkish Lira or Indian Rupees?!

When you need to buy energy to run your business or transport your finished goods, a reasonable price can be the difference between operating and simply turning off the lights.

This point brings us to.....

Joe Biden's Gasoline Problem:

Another week, another desperate effort by us here at Pebble HQ to come up with an excuse not to talk about the US debt ceiling.

Helpfully for us, the debt ceiling drama has been punted to December. If it raises its ugly head then, we will talk about it, we promise. For now, we are carefully doing everything and anything but broaching the most noxious and tiresome of topics.

So, enough with the debt ceiling.

Instead, we would like to point out that we are roughly 13 months from US midterm elections. Time flies when you are either:

Making the jump to hyperspace or

Paying attention to the US electoral cycle.

This means that this autumn is the final chance for real or sizable legislation and policymaking to occur.

Once the new year arrives, the US political landscape will pivot hard to the endless rounds of fundraising, speech giving and general politicking that define the run up to a US election.

One of the topics that may be front and center both this autumn and next year is the price of energy and especially gasoline.

Oil is expensive. At the time of writing US WTI benchmark crude was over $80 a barrel, its highest point since 2014. This translates into gasoline coming in at around $3.25 a gallon on average.

Gas at a dollar more per gallon than a year ago is unsurprisingly drawing attention from traders, consumers and politicians alike.

********

If these elevated prices continue - as we have tried to suggest is likely - the high price of oil and its impact on average Americans will be politically front and center in the election campaign.

A study by researchers at Northwestern University in 2016 found that for every 10 cent rise in gas prices, the approval rating of the incumbent president dropped by 0.6 percentage points, after controlling for other factors.

Intuitively, the President (and his opponents) get this relationship.

The Democrats will try and do everything to deflect and/or keep gas cheap and the Republicans will do everything possible to point out how heinous and terrible and untolerable this situation is.

Same old US politics, same old games.

The problem for President Joe Biden and his party is that expensive gasoline is likely here to stay.

Three big reasons this won't change any time soon:

1. Supply remains super tight! That means there is just not very much oil being drilled out there..

In the U.S., oil production has been increasing but very slowly and we are yet to return to pre-pandemic levels. The last time that domestic crude prices were at this level, there were roughly 1,100 more rigs drilling for oil than the 428 at work last week.

As a result of this lack of drilling, average daily crude production in the U.S. has been 6.7% lower than a year earlier while stockpiles of crude, excluding the government’s Strategic Petroleum Reserve, are 15% lower, according to the U.S. Energy Information Administration.

So, as we covered last week, less supply and more demand.

Here is a chart of US drill rig count from Baker Hughes. They are increasing but very marginally.

OPEC is or was the wildcard. The cartel of oil producing countries could meaningfully add to the world's supply.

There are some good reasons for why they might. Oil producing countries quite enjoy the high and rising prices and might want to make more money but the cartel has stayed disciplined and just agreed this past week NOT to add any more crude production to global markets.

2. Furthermore demand is rising.

And it is expected to continue to do so over the short, medium and long term time horizons as economies re-open and governments continue to try and recover from the terrible pandemic induced recession.

Here is how much gasoline demand has gone this year relative to recent years. It is at the top of the range which makes sense as higher growth = higher demand.

Furthermore, it is not as if anyone wants lower growth. As we have pointed out before, when push comes to shove, everyone opts for economic growth, not less fossil fuels consumed.

This is especially true in Western democracies where politicians are held accountable by voters.

3. Lastly, there isn't much we can really do about the current state of affairs.

The current US administration has talked a BIG game about all the measures they are exploring. Tapping the US Strategic Petroleum Reserve, restricting exports, waving the magic wand and somewhat pathetically asking OPEC to drill more.

The challenge is that all of these measures - other than OPEC - are pretty ineffective. They are nice rhetoric but they do not have much more than a marginal impact.

What can change this tight supply-amid-rising demand situation?

If OPEC sticks to its guns - and they have just said they will - then there are only two possibilities to watch:

China: If China's economy continues to slow then the marginal demand they represent will fall away and the oil market will have some slack. This is an important space to monitor and we will return to it in a future week, we hope.

Plummeting Demand: If something derails the recovering economies in the West, especially in the US, that would also do it. Falling demand would also lower prices.

This makes it tough on the Biden administration. They have not done much to cause this situation and yet they will likely be blamed for it nonetheless.

Choosing between either decent economic growth and high energy costs is not a choice any politician relishes making.

Does this foreshadow a loss in the US midterms, a year out?

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.