CPI Day!: What Does Ever Higher US Inflation Mean For Investors?

We had the US inflation data come out this past week.

Guess what?!

It was hot and higher than expected.

The details:

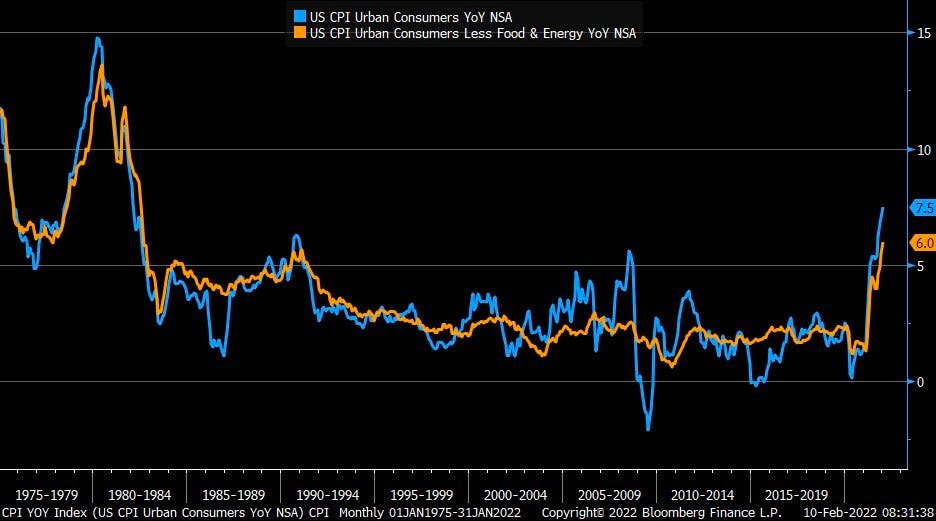

Headline CPI rose to 7.5% year on year.

Core CPI jumped from 5.5% to 6.0% year on year.

Financial markets reacted strongly.

There are now 7 interest rate hikes expected in 2022 and there is an 80% chance of a double (.50% rather than 0.25%) hike in March. That would be very unusual.

There are even rising odds of an unscheduled meeting happening in February (i.e.: now) to get the first hike started.

Big picture it is the same chart, it just keeps going higher while we wait for the March Fed meeting for "reasons:"

People obviously got very excited and there were endless tweets and a lot of talking heads got in a lather and then, after a brief tumble, stock markets rallied and were even in positive territory for half the day.

This sort of makes sense? After all, as regular readers will know, high and hot inflation is hardly news these days and CPI Day may still be the new Jobs Day but rather, everyone is less surprised by high inflation and more anxious about what, exactly, the Federal Reserve's officials will say about the latest higher surprise.

That is why markets may have turned lower when one US central bank official came out in favor of a double hike in March. Thereafter, US financial markets suddenly declined pretty steadily and had a rough day on Thursday and a rough end of the week. Whether this is more about Putin and Ukraine or CPI is hard to tell and likely doesn't matter overly.

Here is the situation as it stands now.

Inflation is still very high.

Rates are still very low.

It is truly crazy that, as of right now, the Federal Reserve will not just keep rates low until next month but will also keep buying assets like US Treasury bonds and US mortgage bonds until March 10.

So a whole other MONTH of asset purchases and ultra low interest rates.

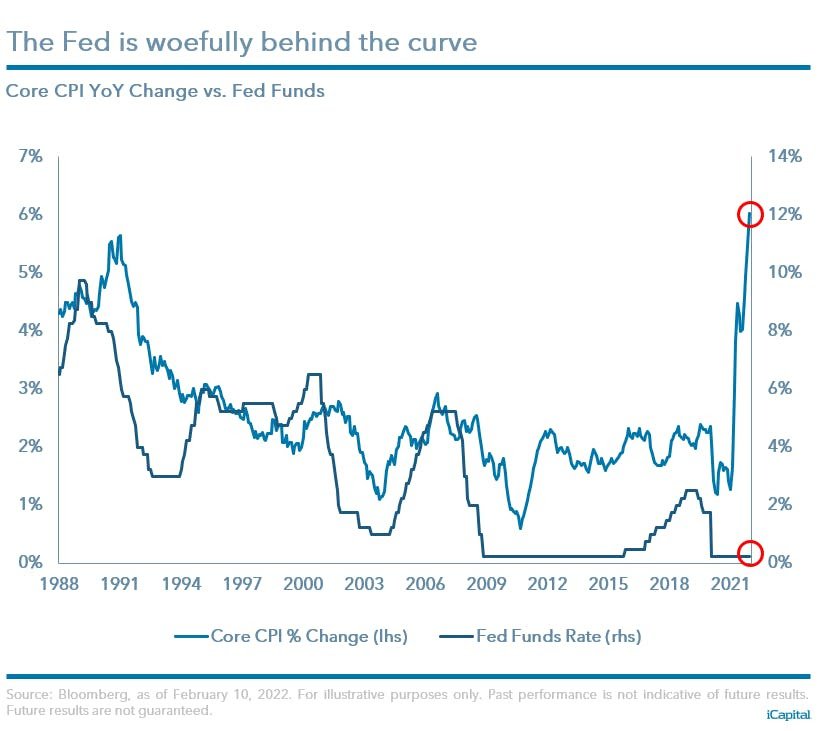

And here is the problem, in a single image.

It is a comparison of the change in US CPI of the last year vs current Fed Funds rate:

The only word for this divergence is "stunning." The last time inflation was this high was in 1982 - when most of the readers of this newsletter were not yet alive - and the Fed Funds rate (the rate the US Federal Reserve lowers or raises was at over 15%).

For additional context, the last time the other half of the Federal Reserve's mandate - the unemployment rate - was below 4% the Fed Funds rate was well over 1%.

Clearly, the normal relationship between a solid half of the central bank's mandate(low and stable inflation) has broken down.

So, when people say "The Federal Reserve is really behind" the above chart is what they mean.

Now, how they catch up and whether they can do it without making the economy suffer is the only question worth asking.

We will hike rates but how many and how quickly and especially how the markets and the economy is the big question.

It is always a shifting target but it is doubly so now. When you are this behind the curve the chance of a central bank policy mistake, rises quickly.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.