2022 Theme: US Inflation Is Still The New US Jobs Number

A few months ago, we raised a question on our Pebble Slack: Is US inflation the new US jobs number?!

By which we meant: is the announcement of US inflation every month the most important new data point for the direction of the US economy, the Federal Reserve and, as a result, financial markets?

It seems like it might be for the foreseeable future.

Why is this important?

Allow us to explain.

*******

For years, the best proxy for the overall US economy was the US job market. As the job market went, so went the perception of how the country was doing economically.

Because of this perceived importance the monthly publication of the new US payrolls number became one of the most important trading days of that period.

This had a certain circularity to it. Jobs mattered (and they still do!) for the US economy but then traders and investors decided they mattered and turned the monthly release around the data into a big market moving event.

Once that happened then everyone else started piling on: the mainstream media, people on Twitter, politicians, the know-it-all at work etc. Everyone was suddenly a jobs expert and endlessly discussing the latest figures with the attention normally reserved for playoff football controversies and whether Die Hard counts as a Christmas movie (it certainly does).

It also became somewhat of a cyclic ritual as well.

People have to talk (and analyze) something and the new jobs number helped fill a lot of hours and gave structure to an otherwise uncertain and very murky world.

Helpful!

Anyway, all of this is now happening for US inflation. Here is why:

As we have detailed previously, current inflation in the US is very high.

This is both unusual and new. It also matters! Having a good paying job is important. So is maintaining your standard of living.

It also used to be very contentious. Over 2021, the economic phenomenon of inflation went from being a potential problem to a small problem to now a potentially very serious problem.

Meanwhile, jobs are plentiful and so relatively less significant for the direction of the US economy. The unemployment rate is very low (below 4%) and wages are rising for lots of workers. There are tons of job openings - and yes, many of them are for "good" middle class jobs.

This theme was reinforced with gusto this past week:

As you may have noticed - after all, it was blared out from nearly every headline, website and, yes, newsletter - the US headline data this week came in high and hot.

The details: Headline CPI rose 7% as expected. However, core CPI (minus food &* energy) accelerated to 5.5% vs. the 5.4% expected.

For context, one-year ago inflation was 1.4%. Furthermore, 7% is now higher than it has been since 1982.

Here is a nice chart for context:

So where does this leave us?

It leaves us looking at a lot of Fed action. And quickly.

Investor expectation has shifted rapidly in the last 3-4 weeks from 3 to 4 Fed rate hikes this year. Just in the last few days, Goldman Sachs finally joined the bandwagon which led to a lot of amusement online.

Here is a useful chart about what is "priced in" and what Goldman is calling for.

What does this all mean?

It suggests two likely outcomes:

As we tried to stress last week, the key isn't that markets will go down (or up!) but rather that a sector rotation will occur under the surface now that policymakers are going to take action to curb inflation. Relatively, new classes of assets will do well and others will fall out of favor. We highlighted the shift from Value to Growth last week and why it may continue. Below we include a second example of unprofitable technology companies.

Obviously, while this happens we must continue to watch US and global inflation data releases like a hawk - especially but not only the CPI release. The amount and direction of inflation is the new key number for the US economy!

The reason?

Because now that we feel confident that the Fed has decided to do something about inflation then our analytical framework must also shift.

This is a dramatically different situation from the latter half of 2020 and 2021. The Fed is going to start raising rates, sure, but it must also be careful not to do so too quickly (or too slowly) to keep supporting the US economy while taming inflation.

This future comes with lots of unknowns:

Will supply chain disruptions diminish?

Will wage increases continue and, possibly, accelerate?

Will other sources of inflation - related to services rather than goods - replace goods-based inflation?

And perhaps most importantly, will the Covid-19 virus have any more surprises for our society and the global economy?

These are big questions and will help determine a) what happens to inflation in the US and around the world and b) whether the Fed is successful in its attempt to curtail this economic trend.

As they develop and provide some clarity, we will be trying to answer these questions in the weeks and months ahead.

For now, equity prices will likely stay supported as long as US financial conditions, which we have discussed several times before, do not tighten too quickly and become too elevated.

*******

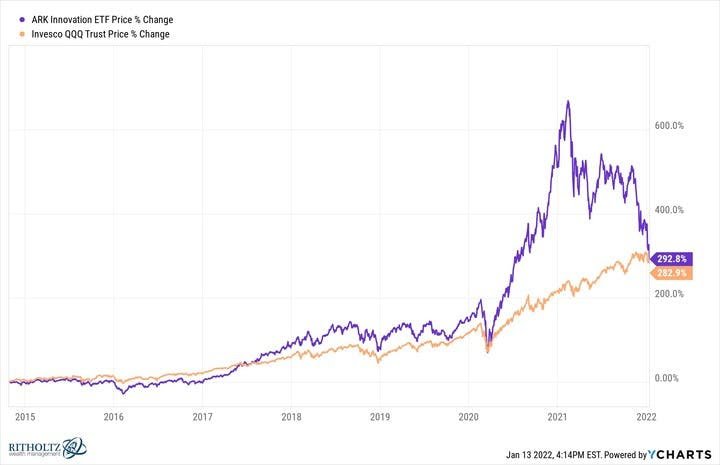

But here is a last reminder about both the power of the sector rotation the Fed has launched with its shift and the rise of real (and nominal) US interest rates.

It is also another plug for staying passively invested and being very, very careful if you do not.

Cathie Wood's infamous ARKK innovation ETF we discussed last week was, one year ago, outperforming the Invesco Nasdaq QQQ ETF by 430%. At the market close on Friday that outperformance had shrunk to 10%.

The ARKK ETF is full of unprofitable tech companies and come with an expense ratio of 0.75%. QQQ is the whole NASDAQ tech index and comes with expenses of 0.20%.

As inflation rose - and raised the probability of Fed action and high real interest rates - so have those companies fallen increasingly out of favor.

Relatively speaking, no one wants to own an unprofitable company - no matter how fast it is growing - if the cost of the capital that this firm will burn is also becoming more expensive.

This may seem like a small shift but it is quite a big one. If capital is becoming more expensive then you want to own companies that create it rather than burn it.

What a difference just a year makes!

Another key question for the direction and strength of US inflation will be energy prices. Economists may prefer to consider less volatile measures like the Core CPI (minus energy and food prices) but regular people do not have that luxury.

They - like you - have to pay attention to the price at the pump and the cost of their grocery run.

There is not much good news there....at least not yet.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.