China’s Tech Purge: Part II - Decoupling Accelerates

The government beatdown of Chinese shares seems like it will continue until shareholder morale improves.

The big story this week was the deepening deterioration of Chinese equities. More specifically, the harsh campaign being carried out by its government against some of its most popular tech companies somehow pushed aside the Fed meeting and a blow out quarter for Big Tech's earnings.

We chatted about this theme two weeks ago and focused then on the Chinese ride hailing giant Didi Global. If you missed it, we have put that piece up on our blog here.

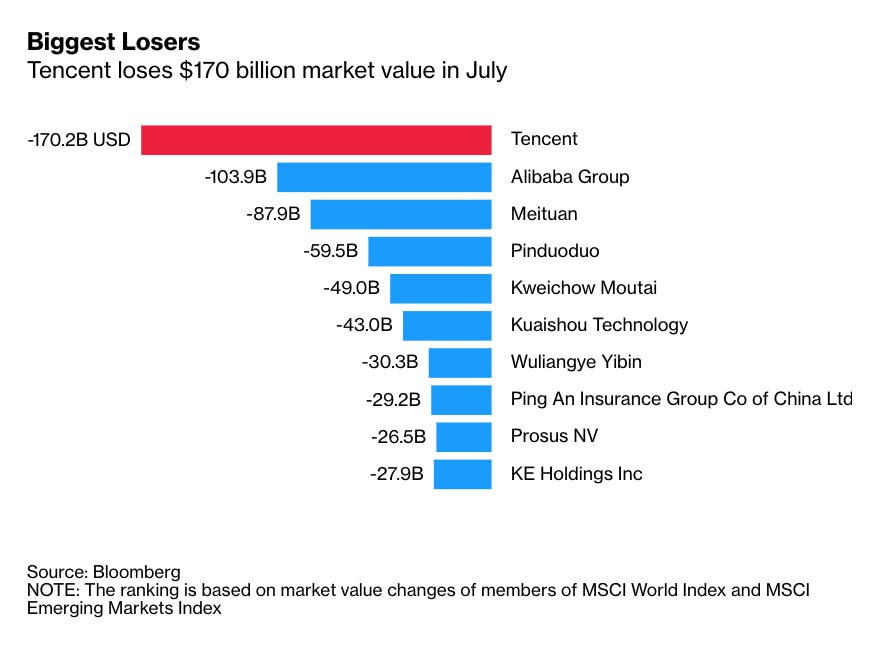

Since then, this story has only gathered steam. This week saw further negative headlines around Tencent, for-profit Chinese education companies and even food delivery app Meituan.

Three clear takeaways:

The Chinese government's continued crackdown is hammering their equity market. Not only are specific company share prices going down but people are leaving the market entirely.

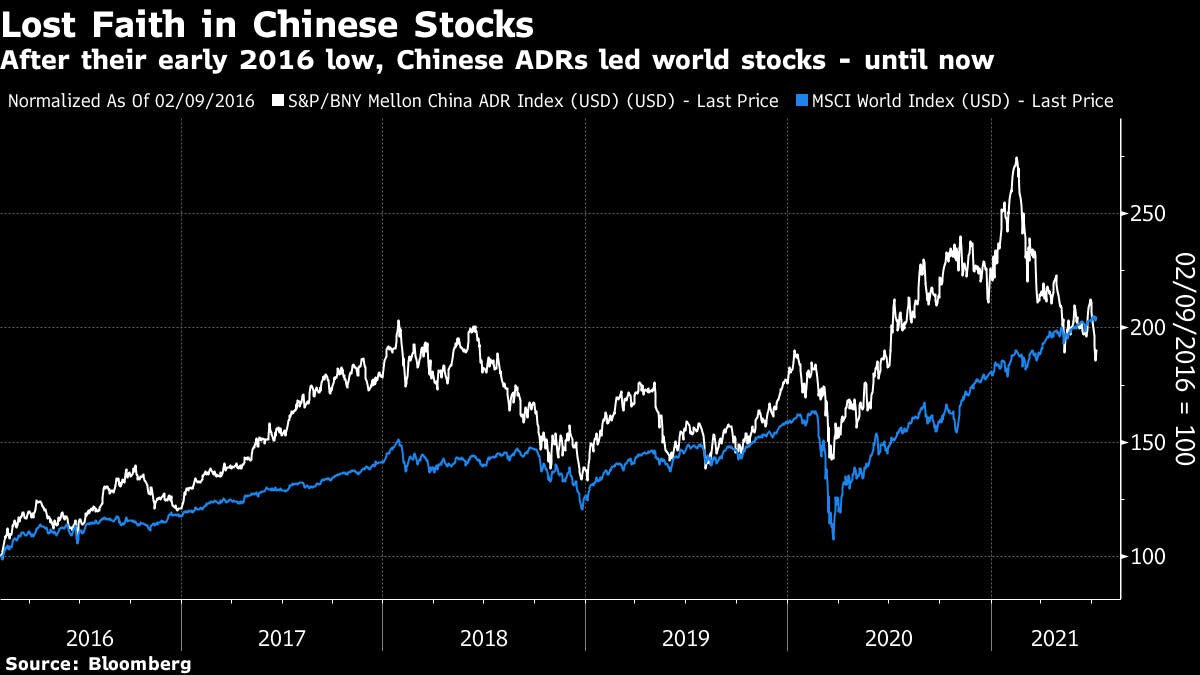

China has been outperforming vs global equities for years. That has now reversed and looks set to continue as the outlook for entire sectors of the Chinese market downshifts.

One dawning realization is that China's government and the CCP is coming to value its growing tech industry very differently from the West. Not only do they want to severely curtail the power (and profits) of consumer facing technology companies, but they may not value these companies in an absolute sense.

Tough month for some of China's biggest and most prestigious companies.

This is a pretty eye-opening thought because a lot of the investments in the likes of Tencent, Alibaba, Didi Global, Meituan, Pinduoduo and many others rests on a key foundation: their growth trajectory will roughly follow that of the West's tech behemoths.

This assumption is now being severely tested.

It is one thing if they have to deal with far more aggressive regulatory Chinese state, it is quite another for consumer technology to be considered a threat to society.

What a difference a quarter makes. Chinese equities were on top of the world as recently as February.

Consequences:

Change in sentiment: As we touched on several weeks ago, a resurgence of US-China geopolitical rivalry is driving increased intervention in the economy. This different approach has profound consequences for the millions of investors, institutions and companies that have invested money in China's technology sector. Not just public stock markets but also private venture capital will be re-examining their models.

Investor flight: Popular commentator and aggressive investor Cathie Wood has largely exited her Chinese positions. She could always return but her shift symbolizes the seismic change in how financial industry is thinking about the once hot Chinese market. Goldman Sachs' clients reflected this new reality this week when they began to ask if Chinese stocks were simply "uninvestable." Ouch.

Structural Differences: It also reminds us and underlines something investors should not have forgotten: China isn't just a different country from the US. It is a different system. And this system has very different structural approaches and strategies for how it wants to develop its economy. It also has different reactions to perceived threats.

One of these differences is that the government is no longer okay with its consumer tech companies going public in Western markets. The CCP fear is that, unless formally decoupled, a New York IPO may mean that Western investors and Western regulators have access to the reams of sensitive data that these companies harvest and that is not acceptable to the Chinese state.

Control over data security is the new strategic priority and a new industrial policy for China seems to be directly against the interests of many of its investors.

A source of strength for Facebook or Uber is a sizable vulnerability for the likes of Didi Global or Tencent.

China Going Forward:

Some of the above was passionately discussed on the Pebble Slack this week and one recurring question was simply:

Fine, things are bad, but will they continue? What is the move here?

Good question!

This above doesn't mean that Chinese stocks won't go up. To the contrary, they might continue to do well thanks to lots of native strengths to the Chinese economy.

But, even putting aside the relative underperformance point made earlier, there are two issues to keep in mind:

1) Be careful what sectors you have exposure to.

The Chinese government is decidedly not interfering in some sectors, This is especially true for companies in defense and hardware - like semiconductors or telecoms - that it judges to be critical to its future development and economic (and therefore political) stability.

However, a lot of popular Chinese ETFs like $FXI or $KWEB have heavy, heavy exposure to consumer technology and should therefore be approached with great caution. The same is also true for many EM equity ETFs. As always, do your due diligence.

2) Watch the broader economic outlook.

Little discussed amid all this focus on the regulatory actions of the Chinese government has been a general economic slowdown and some real risks in the critical property market.

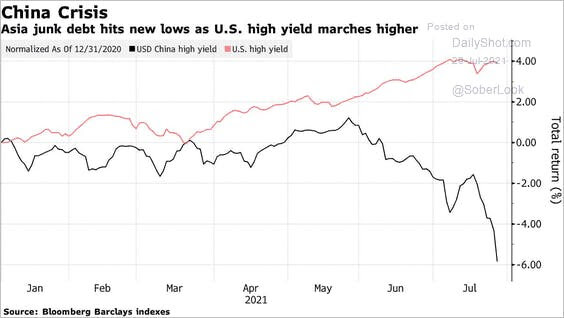

We mentioned that China cut their bank lending RRR interest rate back in Pebble 8 but since then the negative signals have only strengthened. In particular Chinese high yield bond prices have continued to sell off - both in absolute terms AND relative to the US.

US high yield prices have continued to head higher diverging strongly from China's similarly ranked debt. This is a decent representation of the growth trajectories of these two countries at present.

In particular, concern centers around property giant Evergrande, whose bonds and share price had a truly terrible week. Some of this was no doubt driven by the rating agencies cutting the developer multiple notches but the real fear is that Evergrande is simply too levered to survive a growth slowdown and yet also too big to fail.

So, someone, somewhere is very worried about the stability of an overheated property market and the highly levered Chinese real estate companies that depend on it. The pressing question is whether the Chinese government will act to bail out these property developers, further stimulate the economy, or be able to contain the fallout of their collapse.

If they do fail, what is the risk of wider economic contagion and who is, as Buffett suggests, swimming naked?!

That uncertainty and a distinct lack of answers is weighing on investors minds and until there is greater clarity, it seems unlikely that Chinese shares - of any type - will find their near term floor.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.