Boeing - Enough Already: Direct Indexing Use Case II

To paraphrase the classic Jerry Seinfeld line: What's up with Boeing?

Like anyone who flies regularly, we are fans of Boeing and certainly wish the company well. They are a large, important and strategic US company and their sophisticated products are critical for a few different industries as well as American soft power. Like most investors, we own Boeing stock in our passively managed retirement accounts.

However, important is not necessarily synonymous with "well performing." In fact, there is increasing evidence that Boeing is a mess.

The best proof of this is that the company's problems are multiplying. The concern is growing that the rot runs much deeper than initially assumed and could impact both consumer faith and long term profits for years to come.

Here are the facts:

As you probably remember, Boeing had a major issue with their 787 MAX aircraft that they then compounded by not initially addressing properly and the plane spent 20 months without FAA authorization to fly.

While these issues are now thankfully resolved - hopefully for good, though it's a bit unclear - there have been a new spate of manufacturing problems with a different aircraft: the equally strategically important 787 Dreamliner.

Now, this past week, there were a spate of problems with the Starliner space capsule and it is apparently grounded indefinitely.

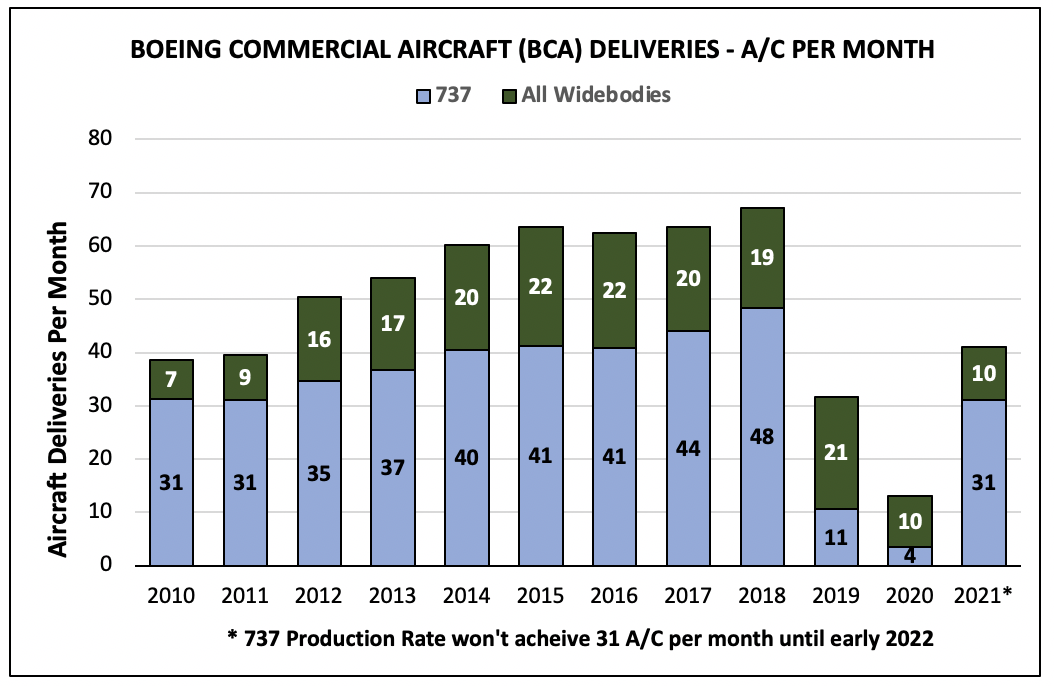

The issues with the Dreamliner in particular have meant that deliveries have been delayed again and again and again. Especially after the 737 MAX issues, hearing the phrase "quality control problem" and a Boeing airplane is not something anyone wants to hear and customers (airlines) are concerned.

There is also the very real hit to profits. Boeing delivered only 2 Dreamliners in Q1 and expects to deliver only half the Dreamliners scheduled this year. Not inspiring.

At a certain point, you have to stop and ask yourself what is going on here. A very kind take might be that there is something profoundly wrong with Boeing's engineering culture and business strategy. One popular argument is that there might be far too much emphasis on the latter and not enough on the former.

A less kind take might be that something has gone fundamentally wrong operationally and Boeing is a company in turmoil that cannot maintain the necessary standards of quality and manufacturing excellence required to reliably deliver its product suite.

Regardless of the precise reason, it might be time to ask yourself a second question:

If Boeing is incapable of consistently putting and keeping airplanes and spaceships aloft then why am I consistently owning their stock?!

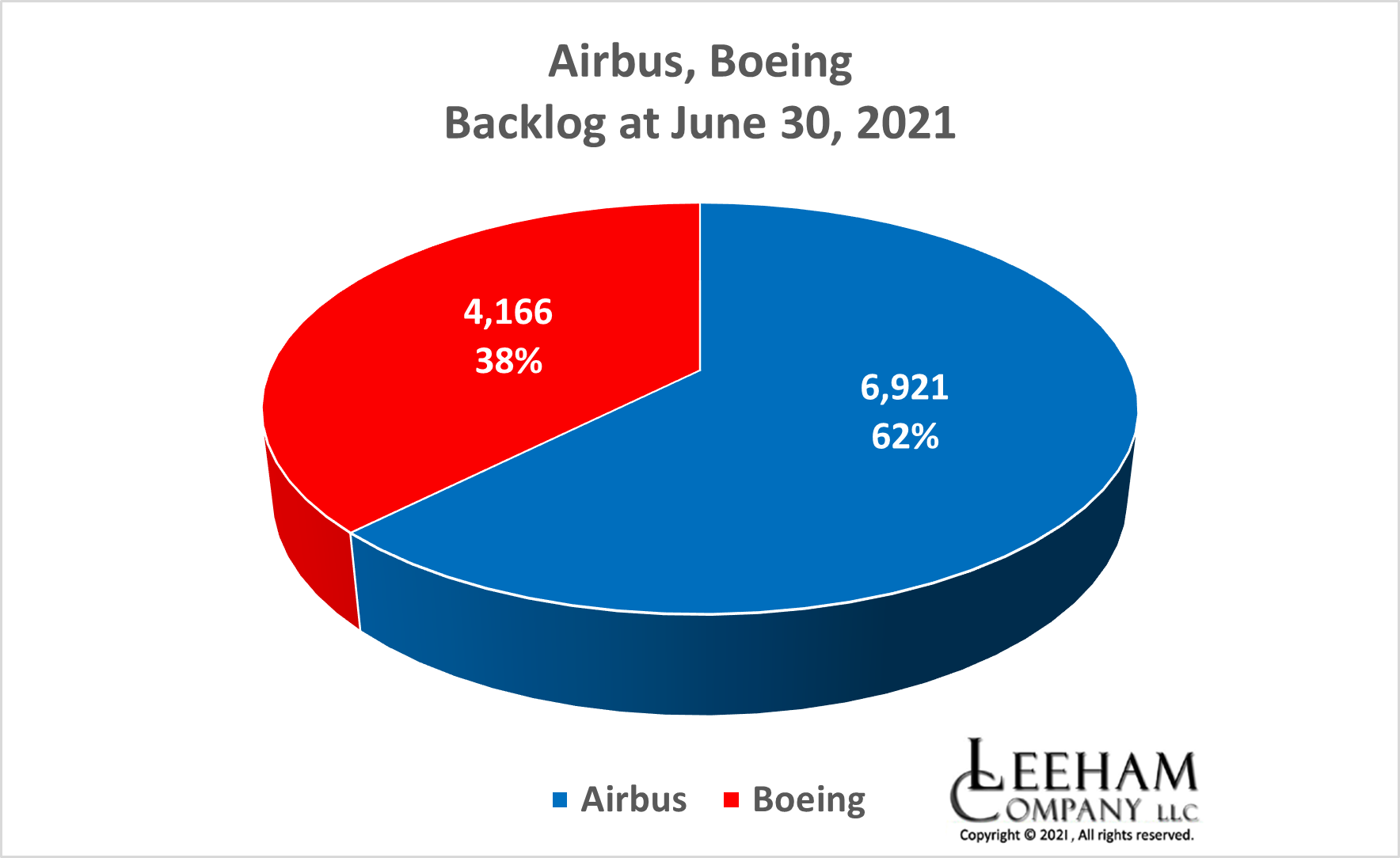

There is no rule that says that you need an underperforming company in your 401k year after year. Yes, Boeing could turn it around next year but where is the evidence for that? The problems first unearthed by the 737 MAX issues are growing, not shrinking. Metastasizing quality control issues is not something a company like Boeing can easily shake off and nor should it.

If you did start to question your faithful Boeing ownership then you likely wouldn't be alone. Here is a comparison of the S&P vs Boeing since the first 787 MAX crash 3 years ago.

Pretty underwhelming. The gap is only widening. Other investors have dumped Boeing. Well, now you can as well.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.