Another Rotation Becomes Attractive: US Stocks vs US Bonds

The irony is that, despite the poor fiscal outlook and especially after the recent stock market rally, US bonds are increasingly very attractive. We have mentioned this twice recently and it is now time to explain in greater detail why we think it is time to start thinking about adding US government debt to your portfolio.

It may seem beyond bizarre to start talking about bonds being attractive when:

The US central bank could still RAISE interest rates (which causes bond prices to DROP).

And we have written a dozen times that the US is proving incredibly resilient and outperforming so many of its peers and competitors.

All of this is true and, as usual, we could end up being wrong but in our analysis the risk reward for US Equities versus US Bonds is very clear.

US stock prices are very expensive. US bond prices are very cheap.

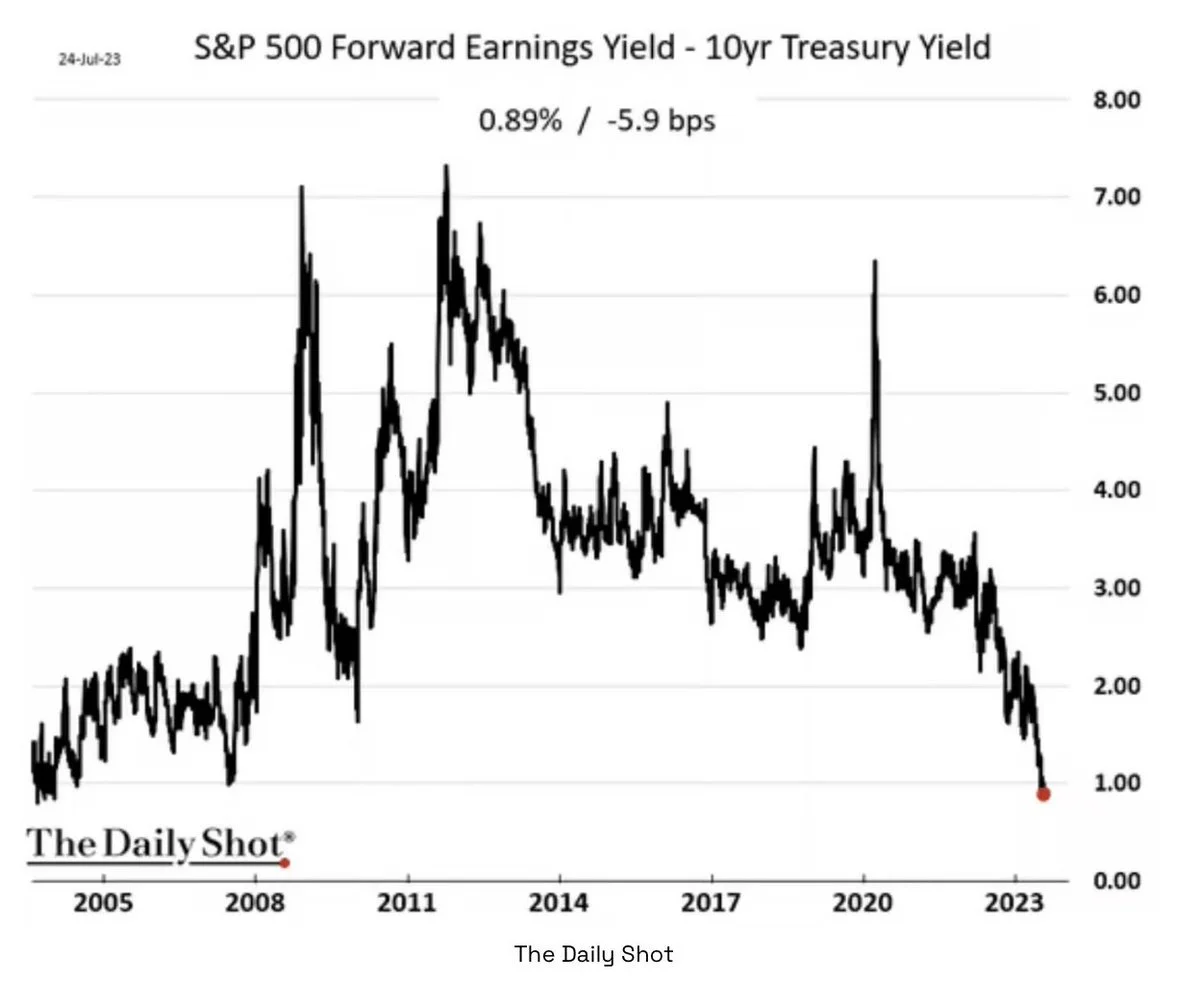

Here is what we mean. The expected forward earnings of the S&P 500 is reaching a record versus the US 10 Year Treasury Bond YIELD.

More important than anything else is the fact it is very probable that this chart will mean revert sooner rather than later.

Don't get bogged down in this graph. It is just a relative risk gauge of the premium associated with bonds vs stocks. But it demonstrates that US stocks haven't looked this expensive vs bonds since 2007.

What this really means is that the chance that the companies in the S&P 500 will make a lot more in earnings is low while the US 10 Year Treasury yield is very high, relatively speaking.

And, of course, 2007 was famously just before the 2008 crisis when stock markets cratered and bond prices rallied very significantly.

We aren't predicting a 2008 scenario but, we do not need actually a Great Financial type scenario for this to work out. In fact, all you need is for US economic growth to slow somewhat and for the Federal Reserve to stop raising interest rates.

The relative risk vs reward is also far more in bonds favor.

Stocks are already very expensive and will need perfectly optimal conditions to continue to rise. Meanwhile, bonds could go higher still and that would hurt but the reward the other way is simply massive.

Here is the risk reward of the US 30 year bond yield if it heads to 5% or heads down to 3%.

You could lose 11% or make 26%.....

So, from a risk adjusted standpoint, it is time to look at longer dated US bonds. The stock market rally we have argued for has occurred and it is time to begin getting cautious and thinking about adding longer dated bonds alongside the Treasuries we have been recommending for well over a year.

It is true there is a real risk to this view and it is a familiar one: inflation.

Inflation would force the Federal Reserve to increase interest rates further which would cause bond yields to rise (and prices to fall). And it could happen. As we have written before, the rise in gasoline prices has us concerned that US inflation could experience a "smile" where it falls before rising back up to look like a smiley face on a graph.

That could happen and means you should watch energy prices and inflation overall but to explore this risk in further depth let us turn to another sector of the commodity complex that is experiencing a lot of attention and F.ear, U.ncertainty and D.oubt or F.U.D.....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.