2024 Theme: Small Caps Update

One of our biggest shifts and also biggest arguments of the last 2+ months has been that US small caps stocks are very interesting and bear very careful watching.

The reasoning was twofold:

These companies' shares should do very well in this environment.

They are an excellent barometer for other, larger issues such as US economic growth.

On top of these we wanted to flag US small companies as part of a broader point to be very careful about buying last year's winners. Lazily assuming that the high flying stocks of 2023 - especially the Super 7 tech companies - will continue to do well could prove very disappointing and even dangerous in 2024.

Well, the new year is already a few weeks old and it has been over a month since we provided an update so the time has come for a refresher.

Now, the big concern is that this view has suddenly become very popular. It might not have been the case in late October or November or even December but to start the new year the "long US small caps / short Big Tech" trade is suddenly become the hot new thing.

This makes us nervous.

It also intensifies our determination to watch these companies prices closely.

Our unease stems from the fact that often these very popular trades do not work out very well for anyone concerned. Think of last year, for instance. To start the year most people thought a recession was imminent and US stocks would struggle and especially the shares of large tech companies.

The popular idea, therefore, was to short US stocks and short US tech especially and certainly fade any bounce. That proved to be dead wrong.

In fact, it led to the bizarre situation where these stocks did great for various reasons and then a lot of professional investors had to rush to try and catch up to a market that was racing ahead. This of course just sent them higher still.

So how about now? Where are we?

Since US stocks made their fourth quarter lows in October and most US small caps indices or ETFs have returned around ~20%.

This has been a stunning move. In fact, it is the most significant 50-day rally in the index since 2020 and one of only 21 periods in the index’s history since 1979 that it rallied that much or more in a single 50 trading-day period.

Despite the strong absolute and relative performance this still leaves them relatively cheap, especially vs their larger cousins of the S&P 500.

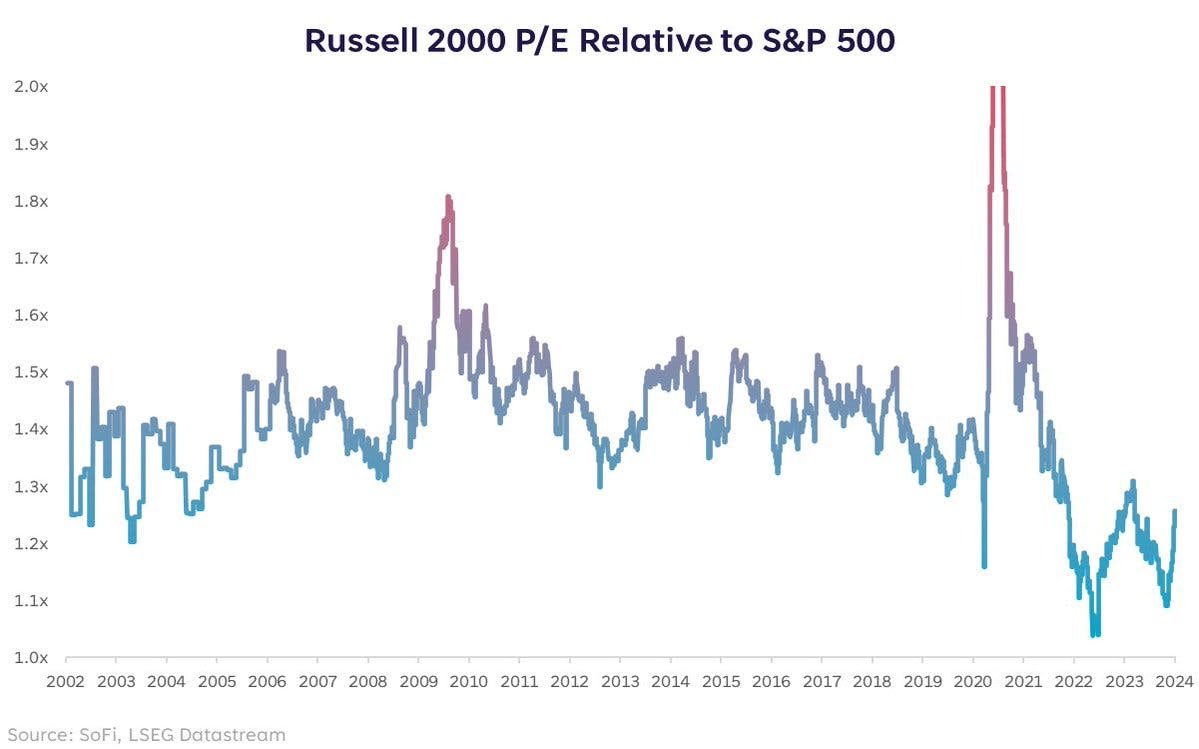

You can see that right here:

The Russell 2000 is a widely followed index of smaller US companies. Despite the recent run up, small US companies are still very undervalued, relatively speaking.

Furthermore, no less an expert than Goldman Sachs has pointed out that small caps have historically done very well in time periods after the Federal Reserve has stopped hiking rates:

They have gone so far as to argue that they could gain as much as 15% in the next 12 months based on their model. Essentially, the Russell 2000 would close the above gap.

Sounds great! So, what's not to like?!

The only problem with all this is.....it is not working right now. Small caps are struggling so far this year:

This graph is since the middle of October and you can see they are giving up a lot of their outperformance. They are a fickle bunch!

Now it has only been a couple weeks and a single swallow doesn’t make a summer and a few weeks doesn’t make a trend but, as we have argued repeatedly, small caps. We actually feel pretty confident this is just a blip but it does focus the mind.

Here is why we are still reasonably confident:

These struggles are based in disappointment about (central bank) policy, rather than worries about the US economy.

How so....?

Well, there seem to be two possible reasons that US small caps are struggling:

Investors are worried that the Federal Reserve will not cut rates.

Investors are worried about economic growth.

Of the two, the former seems far more likely. It also makes quite a bit of sense that there would be some disappointment.

It strikes us that towards the end of 2023 investors were far too positive about the likelihood of rate cuts. This belief was only strengthened when the central bank released their own projections that called for at least 2 interest rate cuts in 2024.

Now, however, we are actually rapidly approaching the next Fed meeting and the odds of a rate cut are falling as investors take stock of the situation. In fact the odds for January are nearly 100% for a "hold" for January and approaching a similar result for March.

The evidence also supports this position. The US economy seems just fine. While there are real risks out there, so far the jobs market is still growing strongly as we witnessed a week ago in the US jobs report for December and economic growth will follow suit. As long as employment stays robust then small caps can't do that poorly.

So, in conclusion, it seems far more likely that investors are feeling less confident about the chance of interest rate cuts. This may challenge the small cap thesis somewhat but as long as growth doesn't truly collapse - or inflation return - the argument should still have legs.

Stay alert but stay positive.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.