Why Is The Stock Market Rallying This Spring? Declining Bond Volatility For One

To start off - weeks since the US has experienced a major bank failure:

Three, (3)!

We will return to the subject of banks and especially bank regulation in the coming weeks as two things become clear:

What exactly the regulatory plan of action is and, in turn

What this will mean for the banking sector and the wider economy.

For now, we can simply celebrate the fact that the world has not ended and revel in the thrill of living to pay taxes for another year.

And what reveling there was!

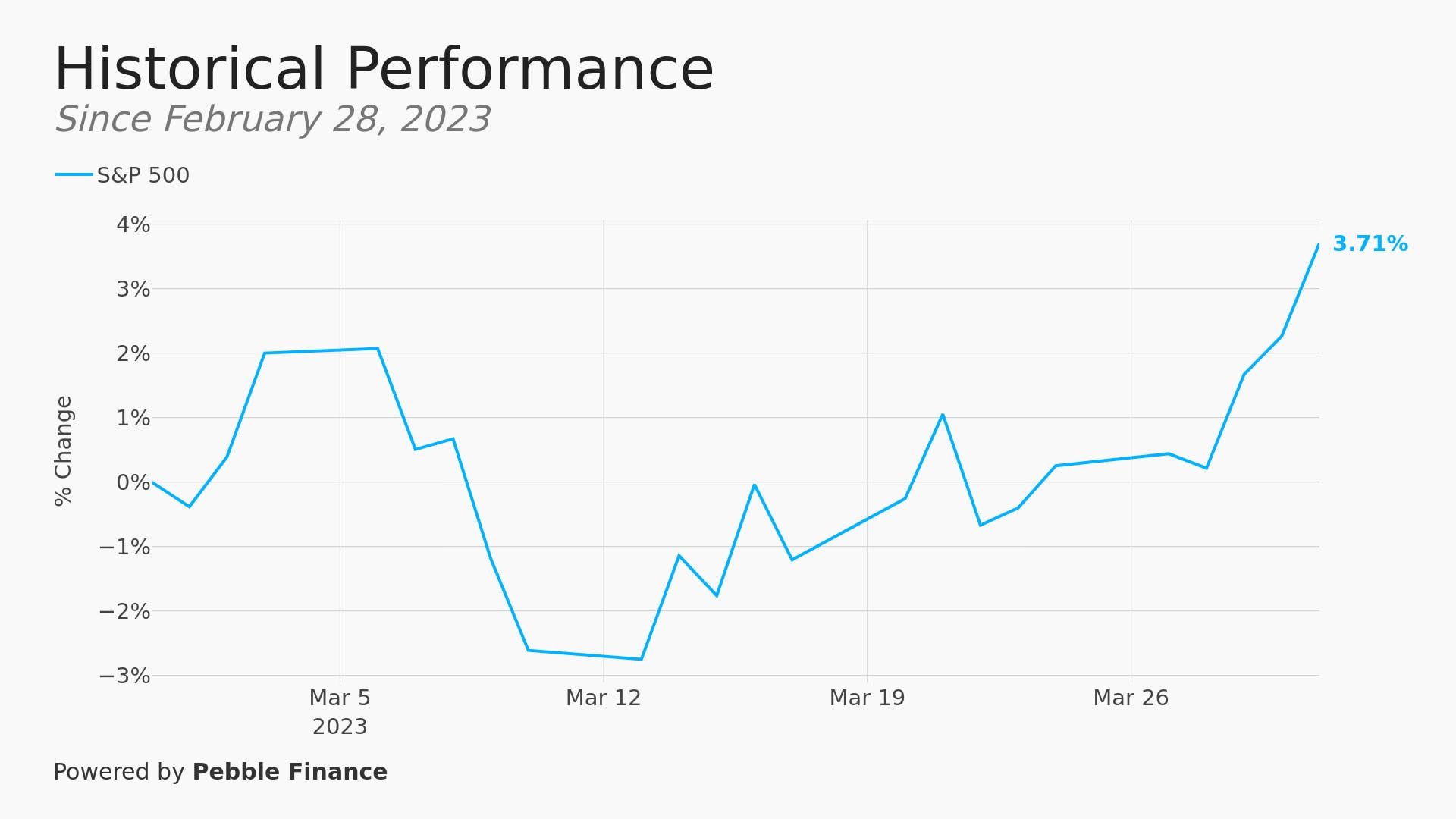

US stock markets had a great week. The S&P 500 was up 2.8%+ and the tech heavy NASDAQ did even better at exactly 3% to enter into a "bull market" by one definition: rising 20%+ this year from its recent lows in December of last year.

This means that for the month of March, a month with a full blown bank run and growing crisis, the Dow Jones average added 1.9%, the S&P 500 gained a solid 3.5%, and the NASDAQ Composite climbed an impressive 6.7%

Bank crisis? What bank crisis?

For those of us who argued that this crisis was neither a 2008 in the making and also quite containable this was very welcome but we will also admit that the degree of positivity was also pretty jarring.

Why did this happen? What changed?

As usual there could be many reasons - no signs of job market weakness, the end of bank panics, companies selling bond, lower interest rates - but one of the most likely reasons underpinning move is simply that bond market volatility has declined from very high levels.

Now, bond market volatility is a bit of an esoteric topic and in the financial weeds so we don't embark upon it lightly but we do think it is very important and so here we go.

As a reminder, thanks to Silicon Valley Bank's sudden demise the US 2 Year Treasury note yield experienced its largest 2 day move since Black Monday in 1987 after the collapse of SVB:

In other words, the 2 year US bond yield collapsed 89 basis points from 4.87% on March 8 to 3.97% on March 13 (over that first, fateful weekend). Further, over the subsequent couple weeks, the US 2 year bond moved by an average 29 basis points or 0.29% a day.

The crisis wasn't limited to just short term US bonds either. It spread throughout the entire bond complex and from there to the world.

An index of US bond volatility called the MOVE index, reached its highest level since 2008:

So, this volatility wasn't just elevated. It was extreme. And indicated we were potentially on the cusp of real crisis.

Why does bond volatility matter?

Well, as we argued over the last few editions, at these levels when bond markets are moving by huge amounts every day/week and jumping around in unpredictable directions then, very rapidly, this begins to influence other markets and also the real economy.

In short, it raised the specter of a 2008-style credit crunch, which would be extremely no bueno.

Why?

Well, simply put, bond prices determine a lot. The price of US government bonds heavily influences the price for all other types of borrowing. Therefore, US bond prices determine how much a company can borrow, they determine the price of credit, they determine your new mortgage or car payment, how much asset managers have to own in 60/40 portfolios and other target date funds etc.

But bond volatility matters even more than the price level. As we argued on the rapid AND volatile US inflation in 2021/2022, when prices are changing incredibly quickly it can be extremely difficult for economic activity to occur as it usually does.

It does so by making it very difficult for companies to raise debt and fund their operations. Very quickly this filters down to the level of an individual borrower or consumer or even just job holder.

The pace of change can matter far more than a level and the volatility of that change may be even more important.

So, bond volatility doesn't just cause plans to change because a factory that a company was going to build now costs more. They cause plans to be frozen or shelved.

In the same way that elevated and rapidly rising inflation raised the question:

Can I live on my salary or can I run my business on what I make?

Bond market volatility asks companies a similar query:

Can I raise the capital in the markets to operate and build my business?

Thus, because the specter of 2008 was gripping markets over the last few weeks it is unsurprising that its dissipation has led to both some very positives vibes out there on Wall Street and a lot of people buying assets to reflect the new, post-Silicon Valley Bank world.

In particular, lower bond volatility encourages hedge funds and other professional investors buy US stocks. Many of them were very short interest rates, when those bets went sour they covered their shorts and were suddenly long bond prices. Now, unsure about the direction of interest rates but finding the LEVEL of US interest rates lower and the VOLATILITY falling, they are inclined to buy stocks.

All in all, that is why we had a whole banking crisis and yet the S&P 500 chart looks like this:

It might have cost quite a bit and leave us all worse off with a more sclerotic and top heavy banking system over the long run but right now, let the good times roll! Ultimately, lower rates and still, we think, higher inflation will lead to higher stock prices.

What is also interesting is which stocks precisely are heading higher. On this topic we have been more surprised.....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.