US Investor Sentiment: Everyone Is Feeling Bearish, Is That Bullish?

All of this makes for a pretty grim newsletter.

Repressive covid lockdowns, wages struggling to keep up with inflation - and especially for the most vulnerable - European/German backsliding, the possibility of yet more supply chain disruptions and millions of Chinese citizens locked in an authoritarian fever dream.

What is not to love!?

So, we thought we should end on a positive note:

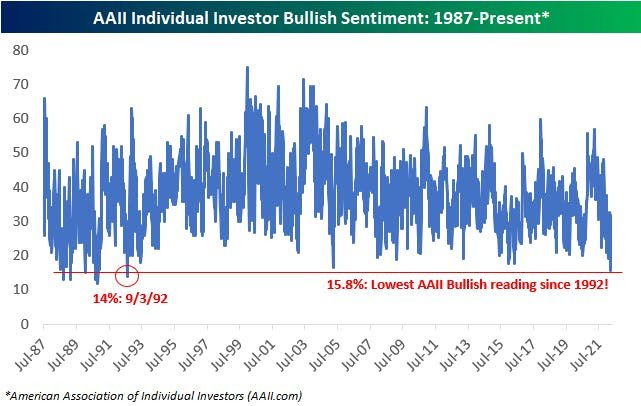

This week saw the publication of the American Association of Individual Investors (AAII) survey. Haven't heard of it before? Well, it is a long running weekly survey of investor sentiment.

It is pretty simple: every week they call their members and ask whether they are "Bullish," "Bearish" or "Neutral." It is a nice and clear approach with a long history.

This past week the survey came out as usual and yet unusually, it recorded that only 16% of investors described themselves as "Bullish" or expecting the market NOT to go down.

This was the lowest level of optimism in not just years but decades.

1992 to be exact. See here:

Furthermore, this was:

Only the 34th time bullishness has been below 20% ever.

The first time it was below 20 on consecutive weeks since May of 2016.

And in the top 10 least bullish indicators ever.

Obviously, this means that bearish sentiment is unusually low.

However, here is the thing about this level of Bullish sentiment. It has often acted as a counter indicator for the actual direction of financial markets.

By this, we mean that typically when investors get THIS negative about the prospect of the market rallying, it usually does over the medium to long term.

Don't believe it? Well here is every time this indicator has been below 20% ever:

Quite the track record.

The only truly negative time period was during the very depth of the financial crisis in 2008.

The precise reason for this reversal is obviously unclear or we would be writing about it at length but there are plenty of possibilities in the months ahead:

A reversal of China's covid policy.

Peace in Ukraine (we can always hope).

Greater signs of growth remaining robust and inflation moderating.

Shifting position from the Fed about the pace of hikes or balance sheet tightening.

Greater advances against Covid.

These might be a few of the most probable.

We have no real insight into any of the above or any other less probable magic bullet that could arrest the present mix of high inflation, lower growth, and a slowing pandemic but a rising war.

Still, the thing about being a market contrarian is at a certain point when everyone is convinced the situation will never improve is exactly when it does.

As General George S Patton famously said:

"If everyone is thinking alike, then somebody isn't thinking."

Stay positive!

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.