US Inflation & Payrolls Reports For July - What Do They Mean And What Happens Next?

We had two important pieces of economic data the last two weeks:

At the end of the first week of August we had critical US jobs number.

And this Thursday we had the all-important US inflation report.

Both data points were interesting but not hugely decisive one way or another. There was sort of something for everyone really. If you think the US economy is trouble you could have interpreted to suit your bias. If you think actually the US economy is just fine then you could also walk away feeling your prior beliefs had been confirmed.

They could go either way, basically.

Perhaps because of the "something for everyone" dynamic combined with the "our modern media environment is very dramatic" we heard from some readers curious about whether:

The jobs market was actually weakening and a recession was incoming.

Or inflation is now on the upswing.

These scenarios would be bad by themselves and truly awful in combination. That doesn't mean they can't happen but it is important to keep things in perspective.

First off, it is true that the number of new jobs is declining as you can see here:

The average was 399,000 new jobs per month in 2022 and we are trending at about half that rate this year.

Compared to this month where:

The US economy added 187,000 new jobs beneath expectations.

The unemployment rate dropped to 3.5% which beat analysts predictions.

Average annual earnings rose 0.4% for the month adding up to 4.4% for the year.

But that is sort of to be expected. The US labor market is incredibly tight at present. At some point there are just few people available to hire and so the number of new hires will be, by definition, less and less.

After all, we cannot make new people appear out of thin air. And it is not as if we are going to overhaul US immigration policy to allow more people, defined any which way, to legally immigrate into this country.

Along these exact lines, the unemployment fell again to 3.5% from 3.6% putting it incredibly close to the all time low it reached earlier this year and demonstrating that there are just not very many Americans looking for work right now.

Put simply, if you have:

Unemployment at near record lows.

US labor force participation rate at near record highs.

And jobless claims (people claiming unemployment benefits) at very low levels.

There is just limited progress you can make in hiring.

The US population needs to grow much faster if you want that to change. But regrettably our demographic growth rate is slowing, not rising.

Fears around the economy slowing leading to more and more workers entering the job search are also very overblown.

Here is the current state of US jobless claims which records the number of Americans claiming federal unemployment benefits every week:

As you can see there are very, very slightly more people requesting unemployment benefits but they are still very low.

The number of job openings are also very high. We have around 1.6 jobs available for every job applicant. That is far above the 1.2 jobs available average we are used to though beneath the 2.0 jobs we experienced in 2022.

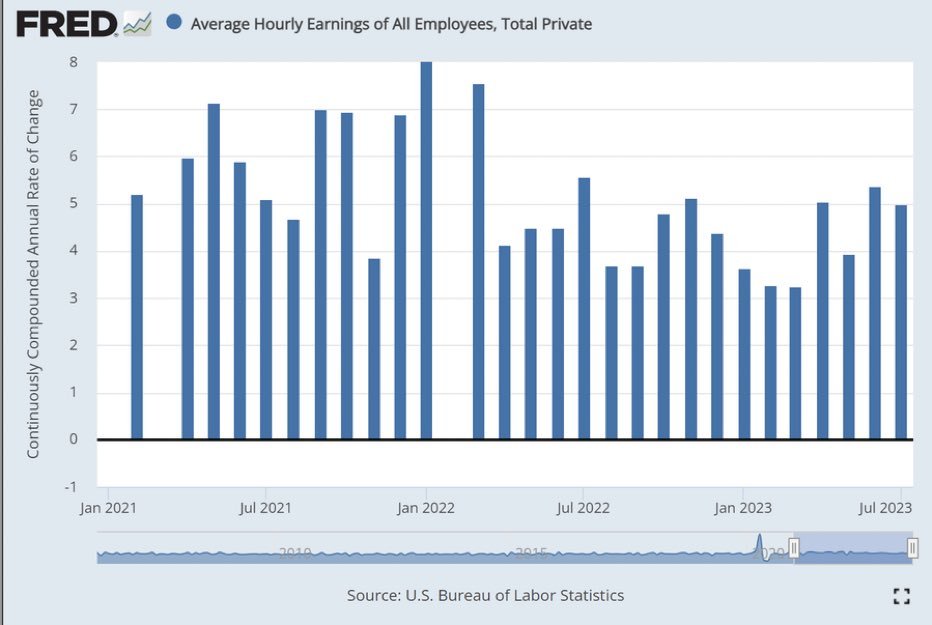

The most notable aspect of the jobs report might have been the part that reported the wages. These rose strongly yet again and at an annualized growth rate of 4.4% are now both above US inflation and a signal that raises are still rising strongly for US workers.

This last number also has implications for wider US prices.

This brings us to US inflation data for July which is both more interesting and more troubling.

In many ways the US inflation data is the exact inverse of the US jobs report. Superficially it seems great whereas it is the details that are concerning.

The basic facts are pretty boring:

Headline CPI to go up 0.2% on a month-on-month basis, and 3.3% on an annual basis, so just above last month's number.

Core inflation was 0.2% on a month-on-month basis and 4.7% on an annual.

The biggest headline is likely that the impressive 12 month streak of declining inflation has now been broken. In a way that doesn't matter. Streaks are made to be broken after all and it is not as if but it does really symbolize that inflation can rise as well as fall and, furthermore, that it already has very slightly.

This underlines the fact that while inflation has fallen a lot, US policymakers may struggle to get inflation down to the central bank's target of 2%. The reason is simple and very, very thorny.

Why?

Well, this is where the jobs data comes in so handy.

Because the greatest positive of the employment report was that wages are rising for most American workers. That 4.4% number is now ABOVE the annual inflation number of 3.3%.

But this has real downsides as well. Wage inflation is proving pretty sticky. Unlike other measures of inflation, they are not coming down:

That is great in the sense that regular Americans are finally earning more than the rate of inflation is eroding their income. Their paycheck is growing again in real terms.

But it also underlines the collective action problem we face.

Specifically, that we can't all get real wage increases AND have inflation come down. As the UPS and UAW workers bargaining shows, American workers are determined to have their wages reflect the recent inflation of their real income.

However, if every American worker gets raises above inflation then by very definition inflation will continue to rise as businesses raise prices to try and protect their profit margins and accommodate the higher cost of labor.

This is the great problem with inflation. It forces us to collectively decide to be worse off relatively speaking. But of course we don't want to accept that. We want our own individual wages to rise while some other poor sucker takes the inflationary hit.

That isn't very practical, of course. Telling modern Americans (or Britons or Canadians etc) that they need to sacrifice and abandon their self-interest and accept being poorer is a very tough sell. They will understandably be reluctant to let their employers (or their neighbors!) maintain their standard of living while they do not.

But make no mistake about it someone will lose. That is perhaps the least discussed and problematic characteristic of high inflation - the unevenness of its impact.

Clearly, as our introduction alluded to, the American auto workers and delivery drivers are determined it won't be them. Plenty of other industries are following likewise. There are wage demands and unionization drives all over America.

Who will it be?

It might be white collar workers. A lot of highly paid professionals are finding out that their slice of the economy is pretty weak and also hard to negotiate higher wages without a union or a competing job offer.

More broadly, we aren't positive who will pay but it will to be someone. We are more certain that wages at an annual 4% rate and inflation at 2% is not going to happen. Something has to break one way or another.

As the US jobs report made clear, with the economy as strong as it still is then the probability is more that inflation rises rather than wages fall.

Sooner rather than later, it is likely we will get an inflation report that is seriously problematic.

Until then, the rotation will likely continue as at least the risk of higher inflation increases week after week.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.