To Hike Or To Inflate? Why Stagflation Is Suddenly Back On The Menu

That is now the question.

This was always the question, of course but now it is being asked in a very different economic context and one that is far more difficult to answer. The tradeoffs involved are nearly all tougher and less pleasant. This is officially economic policymaking on hard mode.

This is because, as we argued in our intro. In the matter of a week, the world has been flipped on its head. What used to be up is now down and vice versa. Perhaps the best example of this is that suddenly inflation doesn't seem so bad!

In an instant we have transitioned from prioritizing price stability to instead placing the primacy of financial stability above all. Over the short to medium term we expect that to continue.

That may seem like hyperbole but right before the entire Silicon Valley Bank drama occurred, Chair Jay Powell gave some very strong prepared remarks about just how determined he and his colleagues were to tame inflation. The short of it was he was quite happy to hike further and for longer if the data warranted.

Well, that was then, this is now.

Most investors obviously didn't love that tough talk and the markets reacted very negatively two weeks ago but then it all didn't matter because Silicon Valley Bank happened.

The big takeaway from this all is the already difficult task for central bankers has just become quite a bit harder. It is still the same tradeoff though: will they continue the fight against inflation and risk tipping the economy into recession or will they ease off, protect the economy and allow inflation to stay elevated for longer.

It is undoubtedly an exceptionally nasty position but what will they actually do about it?

It is very hard to say and we are not alone.

The bank analysts who make a living watching the Fed are roughly balanced on the issue. At the time of writing, it seems as if Barclays, Goldman Sachs and some other strategists see the Federal Reserve pausing rate hikes this week. Meanwhile, on the other side, BlackRock still believes the central bank will hike rates, as does Citi, Morgan Stanley and JP Morgan.

Japanese bank Nomura, possibly reveling in its outsider status, argues a rate cut and a halt to quantitative tightening next week. That means quantitative easing again.

That seems unlikely but it does underline that, even among highly and professional paid central bank watchers, anything could be possible.

Are we avoiding the question?!

Maybe!

In truth, we don't feel as if we have a special edge here but on past performance, it would seem likely that the Federal Reserve will hope for calm this weekend and still hike by the standard 0.25% or 25 basis points. After all, the US economy has just had a major shock and it would be prudent to at least slow the hiking cycle versus previous expectations.

You could easily make the case for a pause, as Goldman Sachs does, but we take it that a downshift in their path will be the safe move and will also hopefully thread the needle between a recession and higher inflation.

Anyway, here is what the markets are pricing in. Investors are pretty neatly divided between a six of one (25 basis points) and a half dozen (no hike at all):

The Federal Reserve has received some new and rather negative information and so that certainly suggests changing the plan. That is what being "data dependent" is all about. To paraphrase John Maynard Keynes, when the data changes, you can change your mind!

We also think a lot of investors are not going to love this. The incredibly high volatility we have experienced will continue at least through the Fed meeting next week (Tues and Wed) as people try to grapple with the aftershocks of a banking crisis and a new path for the Federal Reserve.

But thereafter the situation might suddenly not look so bad.

There is also the fact that much of what has happened since the collapse of Silicon Valley Bank has been accommodative. By that we mean that, in the ultimate irony, the bank's demise has actually solved some of their problems that brought it down (namely high interest rates) and the path forward will be easier than it was 2 weeks ago.

If only SVB were still around to take advantage of these conditions, they might be fine.

A brief list might include:

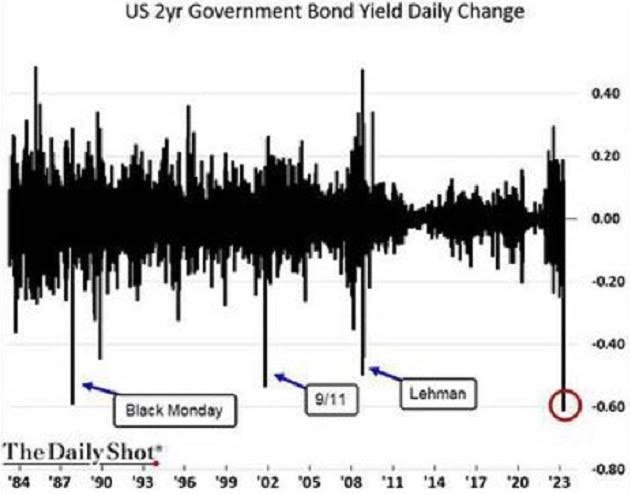

US government Bond yields have gone down and prices have gone up. For instance, the US 2 year bond has fallen from over 5% to under 4%. That is a huge, huge move and means fixed income assets are worth quite a bit more today than last week.

Mortgage rates are down 40-50 basis points. As we argued twice this year, the only solution for the frozen housing market is lower rates. Well, lower rates have suddenly arrived just when we said they were very unlikely! Let nobody say this is easy.....

And most importantly perhaps, oil and energy have cratered. While US stocks have generally held their own (not bank stocks, of course), oil and energy have fallen over 15% over the last two weeks.

As we said above, the move in US interest rates was simply stunning. The 2 year bond move was the largest since the crash of 1987.

Everyone was betting on endless interest rate hikes going forward and now, thanks to a single US bank's inability to manage interest rate risk and deposit flows, we are in a whole new world.

All of these recent moves will help the US economy even though it might not feel like it right now. Most Americans don't have more than $250,000 in any bank account but they do fill up their gas tank every week and pay their energy bill every month.

As long as deposit flight doesn't continue - and we have no reason to think that it will - then sooner rather than later the new reality will drop. The economy is still growing and yet we are hiking, less, not more.

Regardless of what the Federal Reserve and its Chair does next week, traders are already pricing in the belief that they will soon stop raising interest rates and start cutting them.

As of the time of writing the bond markets suggest this will begin in June.

Here is the US 2 year bond busy pricing in rate cuts, rather than future hikes:

Will we see a 5% yield on a US 2 year bond again this year? Or next? It suddenly seems very unlikely.

As we said above, SVB turned the world on its head.

The problem with all of this is that there will be a very significant and high probability outcome from the decision to slow and perhaps even arrest the increase in interest rates.

Namely, higher inflation, for longer.

This is the tricky thing here.

Very quickly we are going to move out of the (justified) panic stage we have been in and instead into the realization that the economy is still fine - because of the strong action taken by the proper authorities.

This will hopefully save the economy over the short term. But it will also mean that inflation will quietly be allowed to stay high and even rise. The battle with inflation will have to take a back seat to financial stability, for now.

What does this mean? In practical terms.

It means that some of the stuff that has done very poorly - like oil and energy - could suddenly be very, very attractive. Commodities and in general, anything "real," will hold its value better than financial assets alone.

Long energy, short financials looks better than ever.

Choosing inflation over the risk of greater financial instability might be not just the best choice but the necessary choice right now but you should prepare yourself for that decision and the world thereafter.

It isn't the only tough choice we are going to be making. US Banking will also be undergoing, what we believe will be, a profound and permanent shift.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.