The Continue Record Rise In The Price Of Gold: A Humbling

Last week, we talked about our relief that our analysis of the utilities sector is finally coming true after several months of not very patient frustration.

Utilities finally waking up is great news for us and hopefully great news for our readers, more importantly.

This week, let us change things up and talk about something we got very wrong:

That means talking about Gold.

In late 2023 we wrote at length about gold and talked about when the precious metal does well and when it does not. In a second post, we specifically addressed the reasons gold had had a fabulous 2023 and why, most unfortunately, we thought that it would begin to struggle in 2024.

Here is the price of gold since:

Oops.

Gold has kept rising and rising. It has now reached a new, new level over $2400 a troy ounce and it still hovering around that price in the high 2300s.

This suggested it was past time for a slice of humble pie.

While it is true that gold is basically keeping up with the S&P 500 that isn't terribly important. It even is that important that we were wrong - though we were. What is important is WHY we were so wrong. That is because what we suggested would happen has, in general, happened.

More precisely, inflation continues to moderate and real interest rates continue to come down - and the US dollar continues to rise!

(gold is priced in dollars obviously and so a higher dollar should, in theory, make it more difficult for gold itself to also rise).

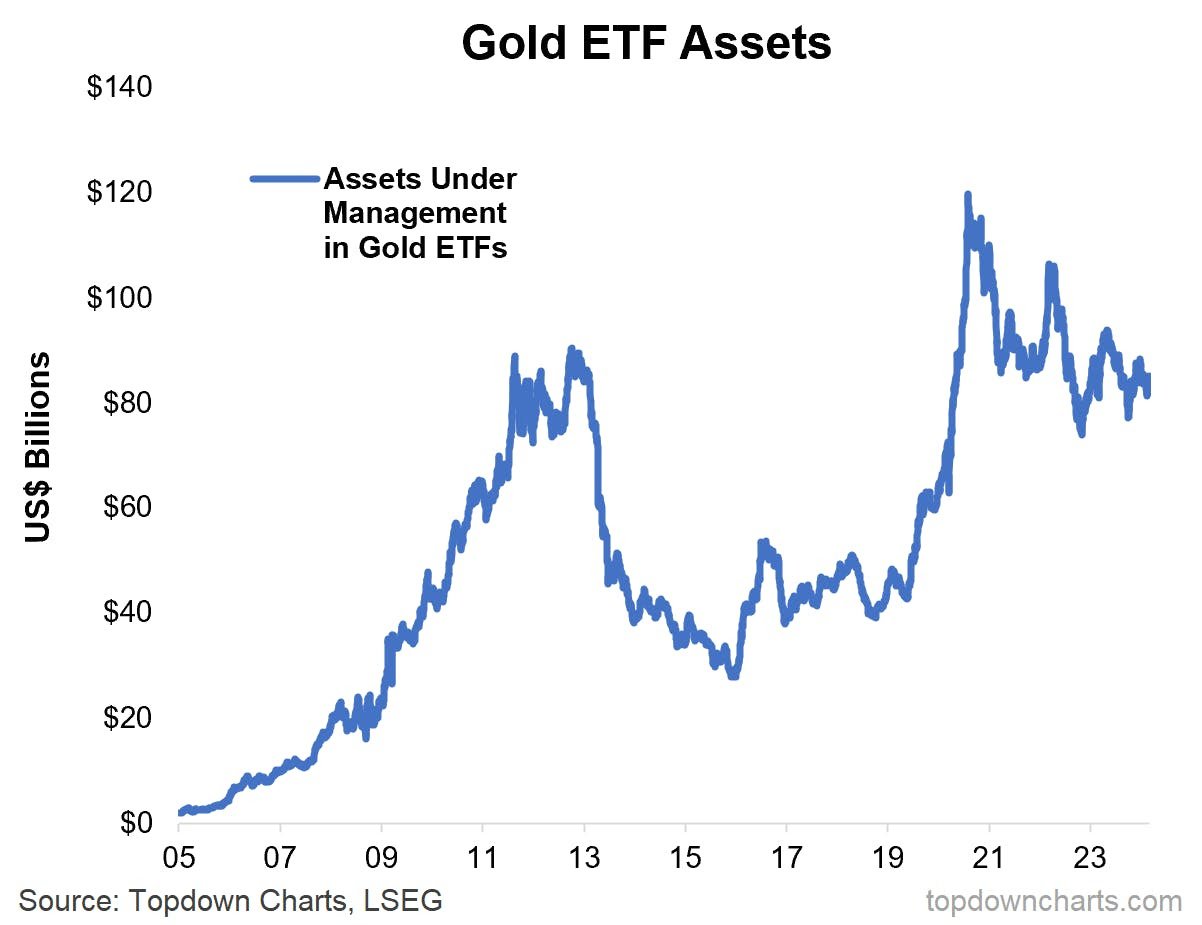

It also isn't US or Western consumers loading up on gold. Despite the headlines about Costco selling out of gold bars the flows of money for physical gold ETFs has actually been negative, not positive. People have been steadily withdrawing money from gold as fears about inflation ease and other assets become far more attractive.

Net outflows have exceeded 113 tonnes in the first quarter, according to the World Gold Council, marking the eighth straight quarter of outflows.

These outflows have continued in April and May.

All of this is what we expected and yet.....

So, then why is the gold price heading higher!?

Good question!

We always hate reasoning after the fact not just because it is easy but also because it is are a few drivers here but really just two:

The first is that gold cannot be sanctioned. Physical gold is annoying to secure and heavy and doesn't earn anything but it is also hard to suddenly seize.

The second is related to the first, China has a powerful hunger to diversify away from holding Western assets with their savings.

An interest in buying gold is equally true for the Chinese people though for different reasons.

It are these two factors and especially their interplay that is driving gold so much higher.

The Russian invasion of Ukraine and the unprecedented sanctions the West launched thereafter profoundly changed the calculus for other states about what they could lose if they fall afoul of Western opinion.

We mentioned all this in our earlier pieces and yet clearly didn't think it would prove decisive. Evidently we were wrong.

The reason?

Central banks have rediscovered the pleasure of gold. Gold has always had the three things central banks value most: safety, liquidity and a certain stability.

Gold prices do move and they can go down but gold has been valued by humans for thousands and thousands of years. This is a little different from NFTs like "CryptoPunks" or cryptocoins like "Cumrocket."

For most of the last 70 or so years most central banks preferred to hold US Treasuries instead of gold (or other assets). US debt had similar characteristics but a better yield and were easy to store and dispose of.

All of these qualities have taken hits, of late.

The reason for most of the change is pretty evident. In an age of inflation, high US deficits and a slow but steady decoupling of financial and trade systems much of this has changed. The attractiveness of holding US (or other Western) debt has fallen considerably and not just because it is increasingly viewed as a bad investment. It might also be a terrible political choice, for a certain type of regime.

That is because the swift and very serious sanctions after Russia's invasion of Ukraine, however, were a real shock. And not just to the Russians. They demonstrated that, even though it might be against their self- interest, Western nations were willing to punish those who went against certain international norms and ethical values.

Those sorts of squishy sentiments don't typically carry much weight in the palaces of Riyadh or the Great Halls of Beijing but they have proven to be more important to the West and a few other allies than many would have believed.

While all of this has been to the good there have been negative consequences. First and foremost, it caused a dramatic re-appraisal of how and where countries stash their cash. Practically speaking, the sanctions against Russia has caused many central banks to re-evaulate owning any assets that rely on the US controlled banking system. Because as the Russians and others have learned, anything in that system is not really yours. It belongs to who controls the system itself.

That is unsettling for a lot countries and their leaders frankly.

In their place these regimes became much more interested in owning physical assets that, even if they don't earn anything, will retain some notional value and also can't be easily seized. Gold is right at the very top of that list.

The $300 billion in Russian assets that remain seized by the West clearly shocked the Russians but more significantly it shocked the Chinese. They realized that, perhaps against the grain of their expectations, that the West could be far more unified and far bolder in terms of sanctioning wrong doers.

They also realized that, with so much of their wealth tied up in Western debt they are especially vulnerable.

That was an unpleasant experience, no doubt. And so the Chinese have been taking steps to correct their weakness ever since.

The Chinese central bank has purchased gold every single months for 18 months now. It has added over 250 tons over that time horizon which is far and away the biggest buyer out there. Overlap that time horizon with the period since the Ukraine war and you will realize it is uncomfortably close.

There are multiple prongs involved here but one of the most impactful and significant and also downright noticeable has been the stockpiling of all sorts of commodities and natural resources.

Gold might be foremost among them. But it is isn't alone.

Plenty of other metals and materials have seen surges of Chinese demand, despite a weak economy.

This is rather worrying.

The obvious implication being that China is trying to increase its stores on many important industrial commodities for unknown reasons. The Chinese state might fear that it might lose access to some or all of these markets and suppliers at a future date.

The implications of all this are unsettling. The debates about how to further extend and expand the sanctions regime might be even thornier.

We will return to some of those in future weeks but for now we look at gold and marvel at its increase and wish we had been more thoughtful and careful in our consideration at just how much the world has changed.

Next time!

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.