Recession Fears Are Overrated: A Single Chart To Think About Where We Are Now.

So far this year, this newsletter has tried to sketch a few broad themes. Two of them have centered on some of the big drivers determining the overall direction of US financial markets.

These arguments are:

The double market shock coming from rising rates and the fear of a "Fed mistake" hurting economic growth and maybe even causing a recession and

This shift pushing investors to rapidly sell expensive so-called "growth" companies and buy cheaper "value" companies.

Putting both of these points together, the takeaway might be that the market went down in January but the real story has been the rotation that has gone on underneath the surface of the index.

This rapid shift has been what has caused the majority of the volatility and high volumes of shares traded.

But now what? Will this continue? Are we destined to go lower still?

Well, here is one way to think about the present state of affairs:

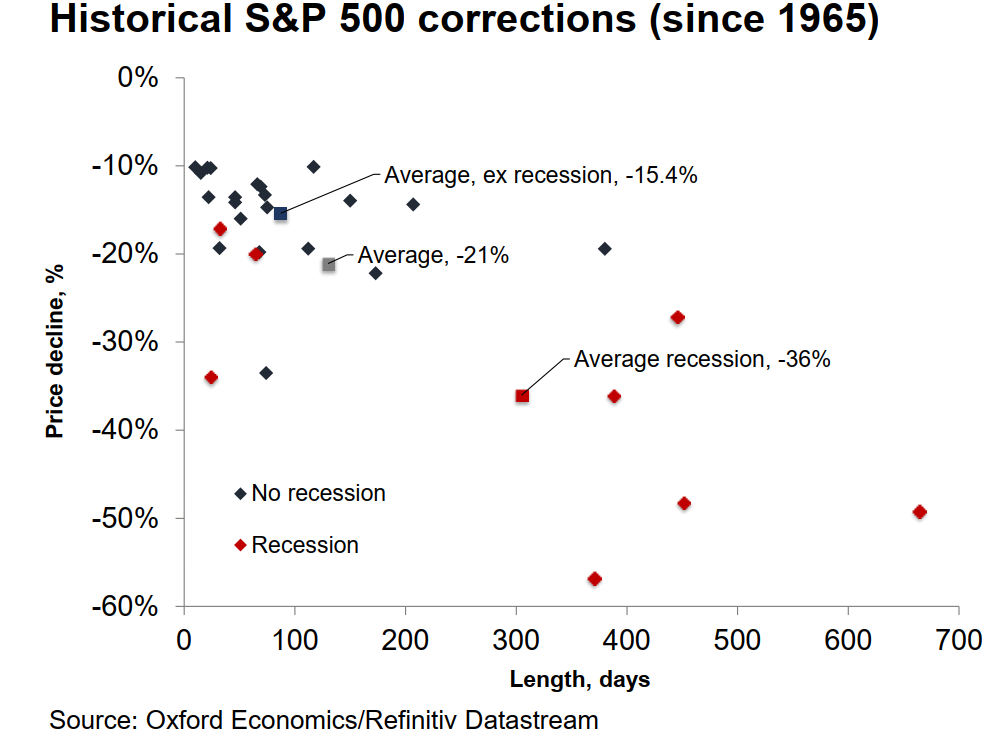

The below chart looks at every major S&P 500 sell off since 1965 and splits them into two groups: those that occurred with (red) or without (blue) an economic recession attached.

Various points:

Since the middle of last century, the average market correction tends to run out of momentum at roughly the 20% mark. Further the average drawdown, once a sell off has reached 10%, stops at 15.4%.

Going back even farther, to 1945, the average S&P 500 decline of between 10% and 20% has bottomed at 13.96%, so the current correction would be roughly on average if the bottom is already in.

There has only ever been one market decline of more than 20%+ that was not accompanied with an economic recession. That was Black Monday in October of 1987.

Both that correction (it happened in a single day) and that macro environment are pretty clearly very different from what we see today.

Past performance is never necessarily predictive of future returns but, as we said last week, for the market to head demonstrably lower it would likely need to believe that the probability of a Fed mistake and an accompanying recession is becoming far more likely.

As this week's very strong US labor market report demonstrated, that probability seems very low in the near to medium term. The economy is robust and job growth, a great proxy for economic growth, remains strong.

The threat remains the high inflation that is eroding people's standard of living even if they are gainfully employed and working hard.

As we suggested the last two weeks, this means not only that the Federal Reserve FOMC will raise interest rates but that they should!

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.