Oil Price Up, Stock Market Down - Why Is This Happening And How Long Can It Last?

Sometimes it is just that simple.

We have reached the point where fears about the elevated oil price and higher interest rates have begun to weigh on both the real economy and share prices.

Days where oil goes up, US stocks go down and vice versa.

Not just that but they are proving a special challenge for the precise parts of the stock market that have done well this year: Big US Tech companies.

This is pretty concerning.

Why?

Because higher oil prices raise the likelihood of higher interest rates which make it less attractive to own high growth companies like Google, Amazon, Microsoft and the like.

The reason for this, as we have covered a few times, is because when interest rates rise they make other assets - such as the short term Treasuries we write so often about - far more attractive than the future profits of a large tech firm that is already at a very expensive valuation.

In short, investors have other (and better) options when Big Tech is very expensive and you can get risk free returns elsewhere.

If investors stop being so enamored of large technology companies and Nvidia then that could have broader implications. Remember that only a handful of big names have been responsible for 70%+ of the S&P 500's return this year.

Trouble for the Super 7 as we have called them, is trouble for the wider market.

And it has. The S&P 500 has fallen 5%+ this month and was actually negative for the 3rd quarter. The major index of large US companies is now only up 12% for the year.

We warned our subscribers in August that eventually pricier energy would begin to impact the performance of the US economy and by extension, financial asset prices like stocks and bonds.

In the end it didn't take very long for this scenario to play out. That speed is mostly because oil has been on an absolute tear recently.

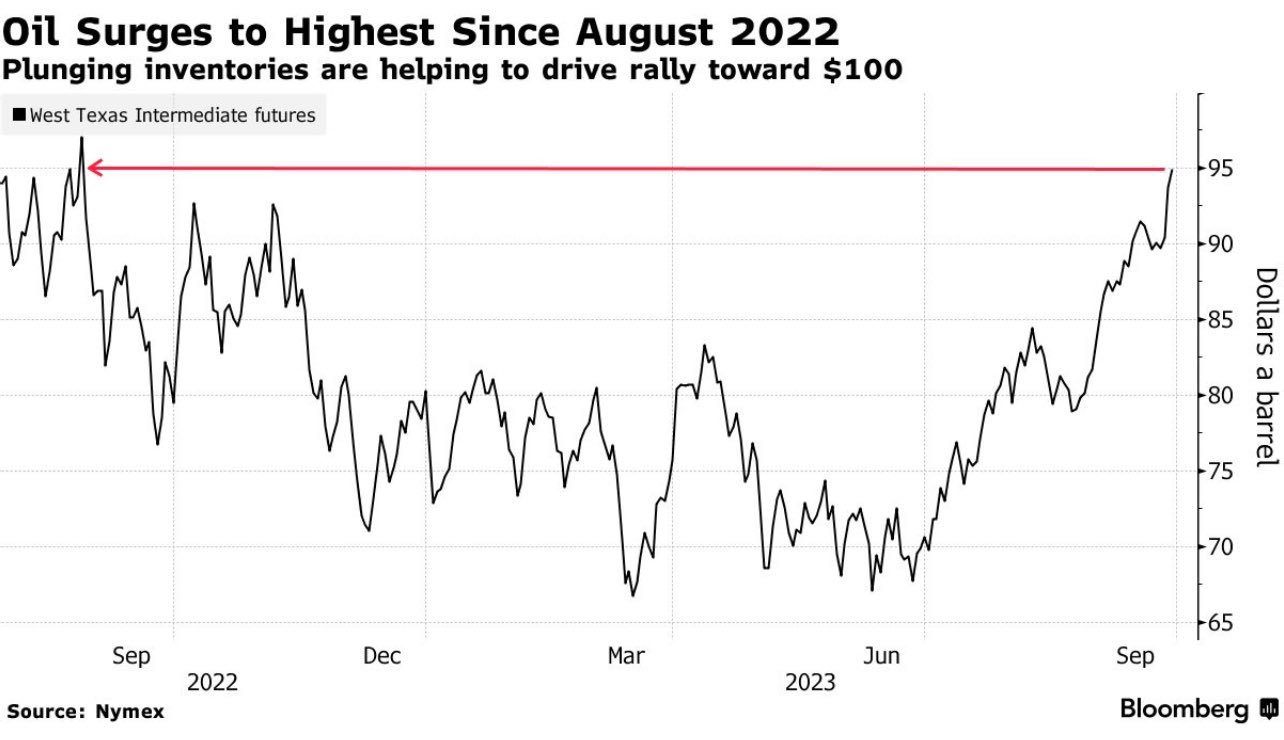

The price of US oil went from $85 just a few weeks ago to touching $95 Wednesday evening (it has fallen back a bit since). Evidently more and more speculators and investors are piling on board the energy train.

As you can see from this graph, this has been a very steep appreciation:

That rapidity matters. As have we have also covered before the pace of change can matter far more than the level with mechanisms like energy costs and interest rates.

The details of this blistering rise are also quite eyebrow raising:

On Wednesday, crude leapt by over 3.6% in a single day when it was announced that US oil inventories were down far more than expected.

Gas prices also are moving up, up, up in tandem with oil and are now well over $4/gallon across most states in the US.

You can see a helpful graph of the inventory picture for US oil here:

That red circle is where we are right now. Falling oil inventories just means that Americans drew down more of the oil available in storage than investors expected - much more. Clearly domestic demand is far higher than most analysts expected.

We also warned that this would send interest rates higher as people begin to expect higher inflation going forward.

That has also happened in record time. In fact, the US 10 Year Treasury Bond has now reached its highest level going all the way back to 2007 and has kept doing so even as some of the US economic data has

See here with the US 10 Year bond YIELD:

Put it all together and it is unsurprising that stock markets have had a bad month.

To recap, the prevailing paradigm right now goes something like:

higher oil -> higher US interest rates -> lower Big Tech share prices -> lower overall stock market

It is important to point out that these higher energy costs will also influence the real economy as well. Ultimately, it is that real world impact via higher fuel costs and interest rates biting the consumer and corporates that is driving so much of this.

The question now, of course, is will it continue?

It might. People are increasingly very worried about the stagflation scenario rising in probability. "Stagflation" was something we experienced in the 1970s where growth was negative but inflation was still high. High energy is a perfect vehicle to achieve this terrible economic mix and so people are now understandably focused on this possibility and concerned.

All of this is leading to the price action we have described where every day oil goes up, Big Tech goes down.

What can change this?

Good question!

The first thing would obviously be cheaper energy and lower interest rates.

That comes about for any number of reasons but the key is that either we get more supply or slightly less demand that will let prices - or at least price appreciation - moderate.

Historically, US stocks have often frequently had a very tough September but then bounced back from around mid-October on to finish the year with two of their best months.

That might happen this year and we are pretty sure that there will be a bounce in here somewhere but we are nervous that both higher highs and a broader rally will be almost impossible to achieve.

If energy goes up, that means higher interest rates and cost of capital. If energy falls that would be a positive in some respects but that would also likely signal that growth is slowing.

You might be able to thread the needle for a bit. That is what happened on Thursday where both US interest rates and the price of oil fell. In lockstep, Big Tech and the wider US market had a great day.

That could happen this autumn if we can find a sweet spot between moderate inflation, decent growth and less pricey oil but it will be hard to maintain for long.

This suggests:

Be very careful about buying this dip, especially in Big Tech.

If you have been chasing returns be very mindful that the Super 7 are still extremely expensive and you may not see higher highs anytime soon.

Continue to watch the oil price for an idea of where the market (and the economy) is heading.

Above all, be very careful about breezy and superficial narratives about what could send the market higher, especially in the most buzzy names.

As we cover below, some of these assumptions are not all they are cracked up to be.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.