Oil Plummets, Energy Stocks Rise - Confusion Reigns

Why oil prices are declining may not seem all that important so long as they continue to do so but this price move is important to try and understand for two reasons:

It can act as a lead for what could be coming down the pipe more generally for the global economy in the new year.

If we understand what is driving this price action, we might be able to better understand what to watch for whether it will continue (or not).

At present, to put it succinctly, it would seem as if the oil price is caught between:

the expectation of declining global demand on the one hand and

the threat of curtailed supply from the OPEC+ cartel, Russian malfeasance and something unexpected like a major terrorist attack or an act of God like a major refinery fire on the other.

The puzzling thing about this neat story, however, is that not all commodity investors are taking fright.

In fact:

Global oil demand is holding up pretty well!

And energy stock prices (i.e.: oil companies) are not declining along with oil.

Let us deal with each in turn:

Global oil demand has now reached over 100 million bpd (barrels per day), which is above the pre-Covid levels and is holding up pretty well, especially considering the many headwinds out there.

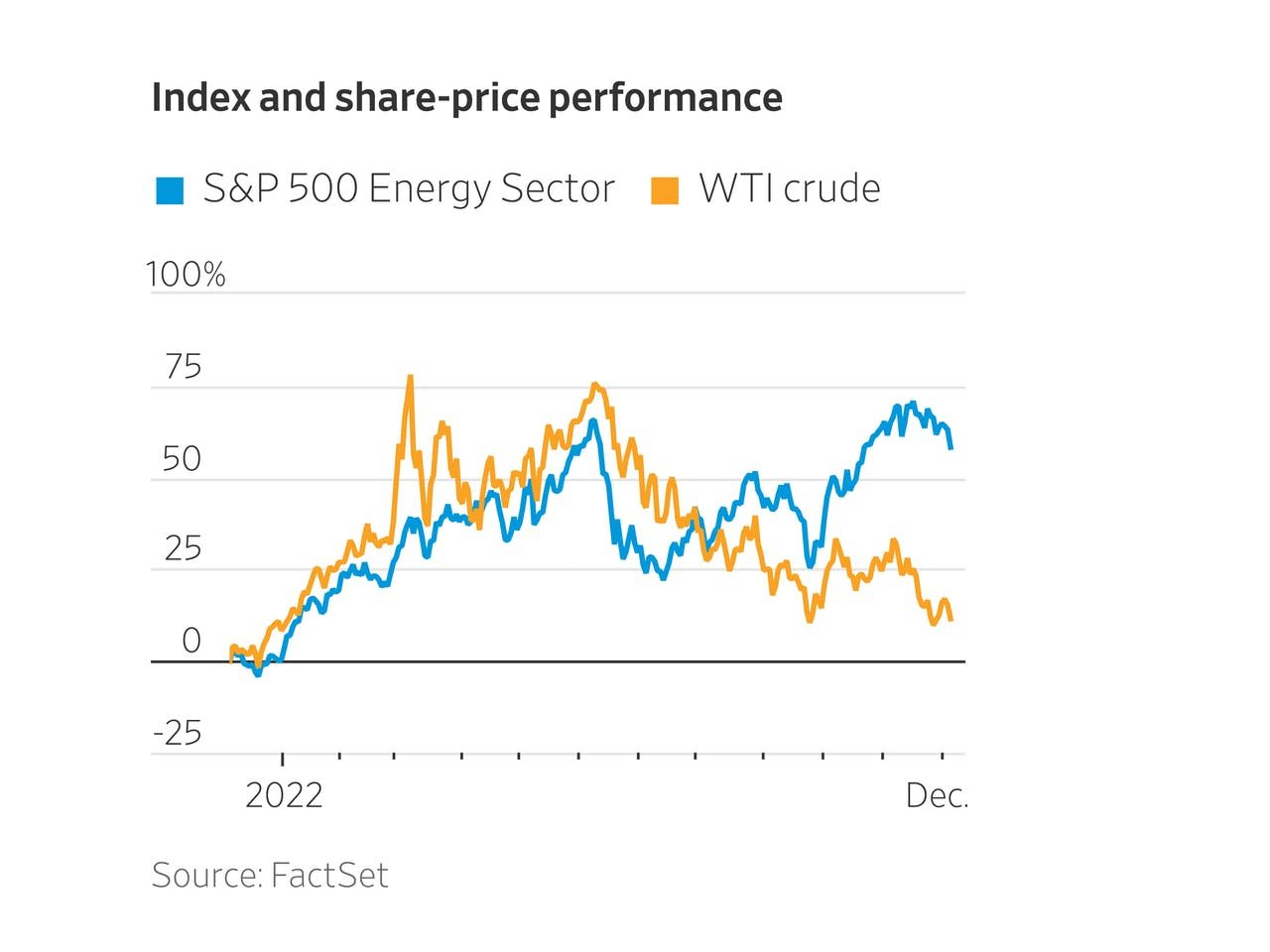

The energy sector has been declining but nowhere near the pace of oil. It is still up over 45% this year where the price is now negative year-to-date.

Here is the present day chart of oil vs energy stocks:

Pretty distinct!

The eye test is backed up by the statistics as well. The energy sector is trading within a few percentage points of its 12 month high right now while oil has fallen over 20% over the last month.

This is unusual. Such a divergence has not occurred since 2006 and has really only happened 5 other times.

So what is really happening here?

Well, what seems to be happening is that investors, traders and speculators are betting that demand will fall, perhaps precipitously, in the months ahead. They are betting on what will happen, before it happens.

This is largely based around fears of what interest rate increases will do to the global economy and just how deep and broad a slowdown we will witness in the new year.

The strength of the Services ISM in our first story this week gave speculators greater conviction that oil will fall in the future despite the fact that it demonstrates a strong economy.

Today's economic strength -> more interest rate increases -> greater chance of a recession in the near future -> oil demand plummets.

This could easily happen! We have argued again and again to be very careful about what the new year could bring, economically and also financially.

Last week, we suggested that something had to give between the different trajectories between US bonds and US stocks (bonds are winning!). This week, we want to argue that we could see something very similar here in the last few weeks or, more likely. the year.

It might be worth pointing out that - while past performance is never predictive of future results - 4 of the last 5 times we saw a 20%+ divergence between oil prices and the energy sector it was oil that rose and closed the gap with energy stocks rather than the other way around.

So, what's the story, morning glory? How should we think about oil prices going forward?

One answer might be found in this chart:

This is a chart of global oil seasonality. So, how does the price of oil do at different days/weeks/months of the year averaged out over decades.

Guess what?

The oil price has an ebb and flow to it like most assets only perhaps more dramatic since, historically, we have used more of it at a certain time of the year. Namely the northern hemisphere's summer is a time where oil demand far outpaces the winter.

What is often termed the "summer driving season" in the US sees more oil demand than the winter which puts more pressure on refiners and producers to have the increased supply in the right place and the right time. This is difficult to accomplish without a significant rise in prices.

We wrote about the real risk of a fire at one of the US' refiners that were working flat out over the summer during that tense time period.

So, perhaps we are just witnessing the usual (and temporary) decline in oil prices that are exacerbated by both the pressures and uncertainties of an unusually high number of unusual issues.

It is very likely that someone will lose between the expectations of energy investors and oil speculators.

Something has to give and meanwhile, we are simultaneously changing and complicating the already very complex global energy market in all sorts of new and devilish ways.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.