Looser US Financial Conditions & The Return Of The Economic Bogeyman

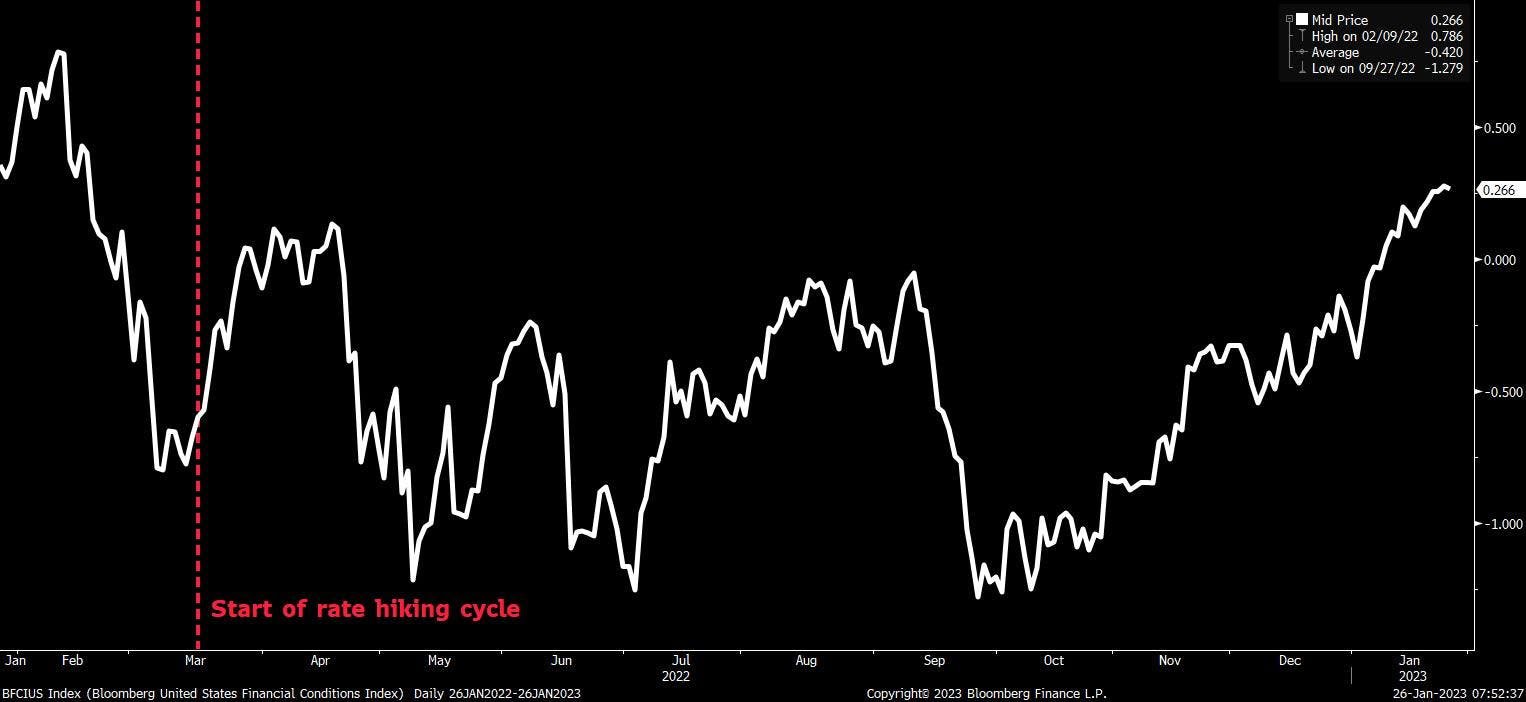

It has been little reported, including on these pages, but US financial conditions have loosened considerably over the last 3+ months.

We used to write about looser US financial conditions a lot. It was a major theme of ours in the sunny days of 2021 when the stock market rose strongly nearly every week and inflation was becoming entrenched but not yet truly elevated.

Our old work can be found here and here.

As a reminder, loosening is a good thing and this represents a general easing of the ability to get credit.

Incredibly, at the time of writing, US financial conditions are now looser (the above chart going higher) than they were at the START of the central bank's tightening actions a year ago.

This has happened because:

Inflation began to slow significantly.

And the Federal Reserve indicated that this could change both the pace and the size of the interest rate increases.

What does looser financial conditions mean precisely?

It essentially serves as a proxy for how easy it is to get credit in the economy. As we wrote about a lot in 2021, looser financial conditions makes it easier for companies (and individuals) to borrow money.

This supercharges growth and also, often, it is very bullish for the stock market.

Why did this catch us offside?

If you had asked us in December or early January we would have argued that financial conditions will loosen a bit but nothing to this dramatic extent for the simple reason that we believe the American economy is still far stronger than people realize.

As one amusing commentator put it around the recent GDP data:

Recession fears intensify as GDP rises 2.9% in the fourth quarter of 2022.

In short, we agree with the above and didn't believe that 2023's narrative would be:

Fed raising interest rates -> economic recession -> lower interest rates/looser financial conditions.

But we also don't believe in:

Fed slowing raising interest rates -> economic growth hanging in there -> lower interest rates/looser financial conditions.

The above discrepancy neatly outlines both the gap in our thinking perhaps but also the problem with investors' assumptions right now:

the Federal Reserve FOMC is still hiking -> And it might slow or even stop this spring but if economic growth remains strong it can always change its mind.

In fact, it might have no other choice but to keep increasing rates against its own forecasts as 2023 unfolds.

Why?

A single and very familiar word:

Inflation.

We can't have it all. And neither can the US Federal Reserve.

Loose financial conditions encourage borrowing (and spending) which will, of course, mean higher economic growth.

If growth stays strong(er) then not only will it be good for the average American worker who will hopefully stay employed but it will also mean that interest rates may not pause for long.

Eventually they may march higher as looser financial conditions spur greater leverage and growth.

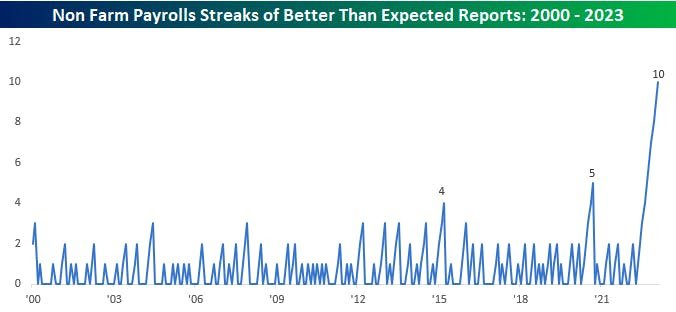

This risk was clearly brought into focus on Friday when the Bureau of Labor Statistics released a VERY strong jobs report for January and one that was also much stronger than expectations.

The numbers were pretty incredible.

Payrolls increased by 517K jobs. The expected growth had been 185K.

The unemployment rate decreased to 3.4%, the lowest since 1969.

Additionally, the two previous months were also revised higher.

There is no other way to cut it: the US labor market is both tough and very robust.

All happening in the context of the fastest rate increase in history and demonstrated that all the hype around losses in technology was just that, hype, perhaps with some unhealthy media bias thrown in as well.

Here is the data from January broken down by sector:

As we argued last week, prominent US technology firms may be strategically important and wonderful stocks to own in your portfolio but they are really not much when it comes to employment. Further, for all the big numbers being let go, there are still many people hiring in the technology sector - hence the low total.

Add it all up and the negative nelly economic prognosticators took another uppercut to the chin from the resilient US economy.

When we talk about how surprisingly resilient the US has been, this is what we mean:

Bespoke Investment's chart above points out that this week makes 10 straight better than expected payrolls reports, double the previous high.

Take that, Karl Marx!

Unsurprisingly and in line with our argument, the US stock market gave up some of its gains. The S&P 500 fell ~1% and the NASDAQ nearly 2% as investors made the obvious connection between higher growth and higher rates.

More seriously however, the Federal Reserve's policymakers will be watching both of these trends - the strong US economy and looser financial conditions very, very closely.

They may be currently trapped by their previous rhetoric and their "forward guidance" commitments but something has to give. Either growth will begin weakening or inflation will stay robust.

For now, though we may have been caught off guard by the strength of the rally and there are other issues like short covering, seasonality and those earnings we keep stressing being better than analysts expect but financial conditions - a weaker US Dollar, cheaper credit, lower interest rates - are largely responsible.

Many investors will be thrilled at the recent performance but for the reasons we have carefully detailed we would strongly urge you to be very cautious with expecting this strong performance in NASDAQ or ARKK stocks to continue. Growth stocks may have bounced and be temporarily in vogue again but if the economy continues then this may be only temporary as inflation comes back with a vengeance.

If you have held over any of the FANG complex or go-go-go growth stocks from 2021 this may be a good time to exit and structure your portfolio for the new age of high growth and high(er) inflation than what we experienced in 2010-2020.

There is no education in the second kick of the mule and so take care to avoid repeating the mistakes of 2022 in 2023! We hope Chair Jay Powell and the FOMC remember that as well when it comes to inflation.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.