Jackson Hole & US Markets

Last week was the all-important Jackson Hole Symposium.

You may have heard of this summit before. The Jackson Hole conference is an annual summer event put on by the US Federal Reserve Bank at Kansas City in Jackson Hole, WY.

(yes, Kansas City isn't very close to Wyoming at all and, yes, they just want to luxuriate in far nicer surroundings than Kansas City in August).

Anyway, there are always big speeches from central bankers, academics and policymakers on the state of the world, finance, the markets etc and this makes it a heavily watched and commented on event.

This year the Fed Chair, Jay Powell, gave a highly anticipated speech about the US economy and his and the Fed's perspective on when and how to do two things:

Slow down or "taper" the emergency asset purchases of US bonds and mortgage backed securities that the Fed is currently doing to the tune of $120 billion a month.

Begin the process of increasing US interest rates from near zero.

There is a lot you could say about both the above and Chair Powell's take on it but the most important point is that he very carefully managed expectations for both of these future policy changes and also separated them from each other.

More prosaically, the stock market loved it.

Outcomes:

By threading the needle so expertly Chair J. Powell accomplished several things:

1) The first and most important is that he continued a lot of theme we covered last month in a post entitled "US Equities: A Rising Tide Lifts All Boats" and we have published on our blog here.

The basic takeaway: The Fed will continue to purchase assets and keep financial conditions easy and real interest rates exceptionally low until we have reached full employment.

“we have much ground to cover to reach maximum employment, and time will tell whether we have reached 2 percent inflation on a sustainable basis.”

That will be supportive of asset prices. So, stocks higher.

2) He also effectively separated #1 from #2 from above. Tapering can begin but does not necessarily indicate that interest rate rises will follow automatically thereafter.

Specifically he said:

“the timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.”

So, one can occur without the other.

Cool, very boring as expected, what do I buy?

Good question. Here are two ideas:

If things continue as expected then growth stocks like the FANGs or technology sector ($XLK) are likely to continue the strong outperformance of the last 3-5 months.

As we detailed in Pebble 13, if economic growth falters, for whatever reason, (Covid, giant meteor, problems in China etc.) then you want to own defensive sectors like Utilities ($XLU).

Both these sectors are already doing rather well as people try and protect themselves from a steadily rising market while staying invested.

Here are sectors since we first spoke about the comeback of the FANGs and the Tech Sector.

Any new risks?

Yes, one. And a biggie.

One of the more interesting things about his speech was he spent ZERO time talking about a lot of Pebble themes.

Market trends such as:

Incredibly high house prices and the follow through to rent and the impact on cost of living for many.

The bottom-up cost pressures that many companies are experiencing for many different reasons. i.e.: inflation.

Any discussion of why - 18 months on - we are still using all of the "emergency measures" that were adopted at the height of the pandemic's disruption of markets and society/the economy.

All of this means that Chairman Powell is downplaying the risks of these factors being important. That is where his blindspot is and that is where a "Fed mistake" can occur - on the side of too much inflation, not too little.

US Economy Bonus:

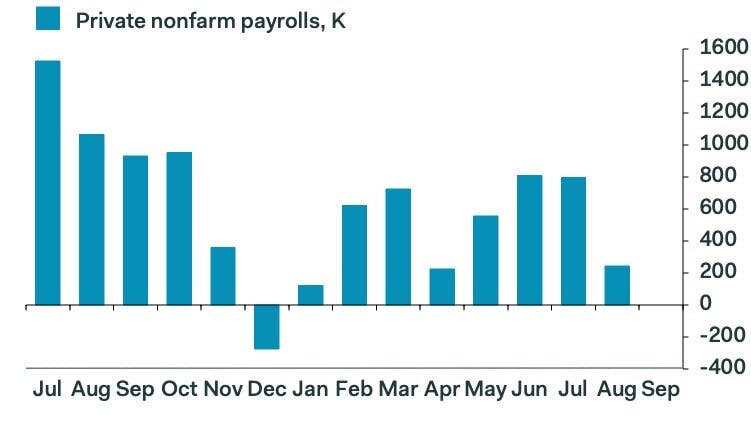

This past Friday's US jobs report was a perfect encapsulation of this trend.

The weak BLS employment report - 235k actual jobs created vs 733k expected (ouch!) - underlines the Fed's dilemma perfectly.

If the US employment does not rise towards the Fed's definition of full employment quickly then they will slow the timeline of both the taper of purchases and the increase of interest rates.

That will only stoke the rise of financial assets higher still and increase the uncomfortable divergence between the US economy and US markets.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.