How To Think About The 2023 US Debt Ceiling Impasse

You know what is also not helpful for US economic growth? Or funding the ever growing US entitlement programs?

A political fight that could cause - no matter how remote - a US debt default!

We have tried to avoid the subject of the US debt ceiling and for good reason. It is a tiresome subject, an entirely self created crisis and one that is difficult to really analyze usefully let alone interestingly.

As a result, unsurprisingly, we have tried to stay well away from this subject but we are now possibly only days or possibly weeks away from the debt ceiling impasse becoming a full blown crisis so, regretfully, here we are.

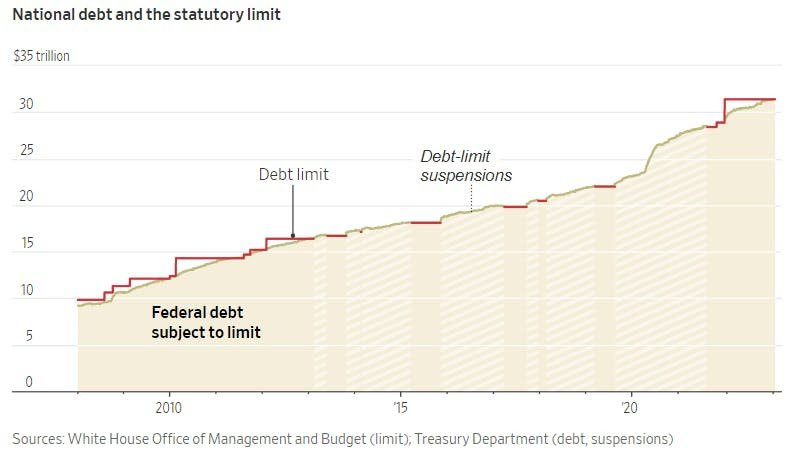

At its heart, the debt ceiling fight is pretty simple. The US needs to borrow more money and to do that the government needs to raise the debt ceiling periodically in order to do so. This provides an opportunity for budget-style negotiations and political brinkmanship if votes are needed from whatever party isn't holding the White House.

Here is what this looks like, graphically:

We are not going to play the blame game here because plenty of others will do so but we will point out two facts:

Against the expectation of really everyone, the Republican caucus in the House of Representatives got their act together and passed a very sensible piece of legislation to raise the debt ceiling in return for some changes.

This package isn't bad! To simplify it extremely, the Bill raises the ceiling by $1.5 trillion and in return slows the growth in government spending. Not the overall amount of spending, just the pace of expansion.

This also seems, pretty sensible? It might even seem too timid?

It can't even be termed austerity. At best it could be termed: throttling down.

You might think that President Biden and the Democrats in the Senate would simply pass the package after some minor negotiations thereby avoiding the risk of a catastrophic default and proving to the naysayers that the US can still be both fiscally responsible and politically sensible.

You would be wrong.

The President is pretending that compromise is impossible and the Senate Democrats are pretending that they aren't actually in charge of the upper house of Congress.

At the risk of getting overly political, we can well remember when it was the Republicans who were the "Party of No" during the Obama Presidency. They were the ones who played dangerous games with the debt ceiling back in 2011-2013. These days it would seem as those roles have somehow flipped and the Democrats are being intransigent.

The only difference is that the Democrats, playing today's Party of No, are holding the Presidency and the Senate. Perhaps someone should remind them?

The whole affair is pretty strange which is another reason we have simply hoped against our better judgment that sanity would prevail and we wouldn't have to write about it. It is quite a situation to be writing about the virtues of Treasury Bills and other short term US government debt when the country's own government is threatening to intentionally self-immolate its credit rating like a lemming throwing itself off a cliff.

Once again, bizarre.

The other tricky part of all this, besides the basic politically insanity of it all, is the timing. The unpleasant fact is that we don't know exactly when the US will run out of available cash. We are all flying blind, as it were.

The US Treasury manages this process but - especially as we get close to the X-date - it is more of an art than a science. After all, the US government bean counters are not entirely sure how much money they will take in via tax this year. They have a pretty good idea but the money has to arrive and they can't know to a penny how much Americans made or traded or are willing to send in. The early signs are that the tax take is far less than expected.

Anyway, this uncertainty around timing doesn't help matters. It makes it harder to drive compromise in DC with a firm date and it also makes market participants extra jumpy.

Recently, Janet Yellen stirred things up quite a bit when she announced that the US could run out of cash by June 1. THAT got things going and focused minds in financial markets. The non partisan and highly expert Congressional Budget Office then also came out and also moved their timeline up from early July to mid-June and possibly earlier.

Regardless of what the exact date is, the takeaway is pretty simple: time is ticking and things are uncertain. Get to work people.

Suddenly, we went from thinking we had some time to suddenly looking at the calendar and realizing we didn't at all. Here is a helpful summary of the expectations from various major banks:

All of this has, unsurprisingly, had an impact on the markets as well. The S&P 500 hasn't taken fright yet but the bond market has already registered concern. Here is the "kink" in the curve as the short term Treasury market reacts to the risk - small but growing! - of a default.

President Biden and Kevin McCarthy, Speaker of the House, will be meeting this week (again) to try and hammer out a deal and there is an eminent deal to be made.

We will simply have to hope they will, of course. Both their staffs have been meeting regularly and it could happen but we suspect we are nowhere near close enough to the deadline yet.

What to really say about this?

Away from the narrow and nasty politics of it all we would say this:

US government spend growing at a less than stratospheric pace is likely a good idea.

The debt ceiling is a classic black swan event. A default is a low probability, very high risk outcome and nearly impossible to predict. Lots of people will try and then either go quiet if they are wrong or crow if they are correct.

Nearly everyone is just a passenger here and it is sort of foolish pretending otherwise. What can any of us really do to minimize the damage of a default other than hope it really doesn't happen?

The cynical move is to simply load upon short term Treasuries. These are riding high thanks to the uncertainty and so you can simply assume that sanity will prevail and make an extra chunk when the ceiling is raised.

The more practical approach is to either buy and invest for the long term and hope the US does not default or, if you are very concerned, simply de-risk and wait till the limit has been raised.

If pressed, we would argue that President Biden is less of a cantankerous and reckless cowboy than he has been playing on TV. He has an important election to win in under 18 months and needs a growing and stable economy for that to happen. He also doesn't want to go down in history as the guy who permanently damaged the phrase "full faith and credit" of the United State government. He cares about history and his place in it far too much to risk a default being part of his legacy.

Wouldn't it be ironic if the threat of Donald F. Trump back in the Oval Office is the only thing that can bring sober and sane bipartisanship to the nation's capitol?

Stranger things have happened in DC and not just in the Trump administration. After all, this was a town who's football team sold expired peanuts from a defunct airline....

Whatever the forcing mechanism is, it is clear that a deal remains very possible and if we can only get this off our plate then things could be looking not bad for the remainder of the summer.

For that we turn to the good news!

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.