Fitch Downgrades The US, What Does It Mean For You, For The Country?

As we noted in our introduction: Wall Street, the US Government and much of America's expert class were surprised and angered when Fitch downgraded US debt this week.

It is true that the act itself smacked of a political stunt and one that seems particularly inept when America's economic trajectory is:

Accelerating.

Performing better than expected.

And also doing far better than its global peers and competitors.

The US has too much debt and TERRIBLE long term trajectory for many of its core social welfare programs (see chart below) but the economy is growing at present and we are doing almost universally better than all major developed countries at the moment.

See here:

Furthermore and most importantly, the US has just passed and is busy implementing several various serious pieces of legislation that are supposed to transform our economy and society. We have SERIOUS doubts about many aspects of those policies but it does nonetheless seem a puzzling time to downgrade a country that is trying to implement major reforms and policies.

We wonder what Fitch thinks about China with 20%+ youth unemployment? Or the United Kingdom where average weekly pay has now fallen to a level last seen in 2007. At a macro level, British GDP per capita has fallen from 81% of the US to 68% over that same time frame.

Those are some dire numbers....

Anyway, perhaps Fitch will be getting to other countries next quarter? We would love to hear their thoughts on Italy or Germany long term debt sustainability as well.

Still, while this rating change may have been both politicized and more marketing than anything else, it is interesting to take this opportunity to think about the state of US's economic health.

In particular, it is interesting to compare Fitch's downgrade with the last time the US debt lost its AAA rating back in 2011 when it was S&P doing the deed.

The most obvious conclusion is as follows: the US' fiscal situation has changed quite a bit and in nearly every case, it has changed for the worse.

Here are the details:

Back in 2011, the ratio of US debt-to-GDP was a very respectable ~65%.

Today, the Congressional Budget Office expects it to be over 98% by the end of the year.

That is quite a leap in a little over a decade and one that has witnessed, in general, a very strong US economy.

Even worse, debt-to-GDP is expected to rise to 115% of GDP by 2033 according to those same nonpartisan experts at the CBO.

As Fitch itself also notes, U.S. “general government debt,” including state and local government, is more than 2.5x greater than the median GDP for a AAA rating elsewhere.

Keep in mind that the CBO track record has been, if anything, optimistic only because the US government can't seem to stop using any excuse to raise spending. The right's unfunded tax cuts are equaled by the left's unfunded social welfare programs.

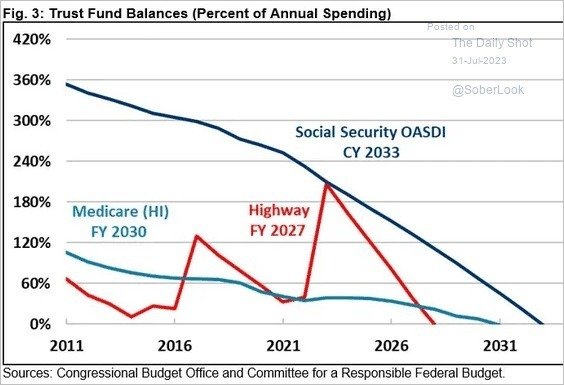

This newsletter has covered the issues with Social Security before but here are how a few of the other major fiscal trust funds' trajectories are looking:

In summary, it is pretty obvious that conditions have only deteriorated today compared to 2011. Whether it is the debt-to-GDP ratio, the politics, the spending, the deficit, the entitlement spending, the tax base, etc. etc both S&P and Fitch may be vindicated that the US is only heading in one direction.

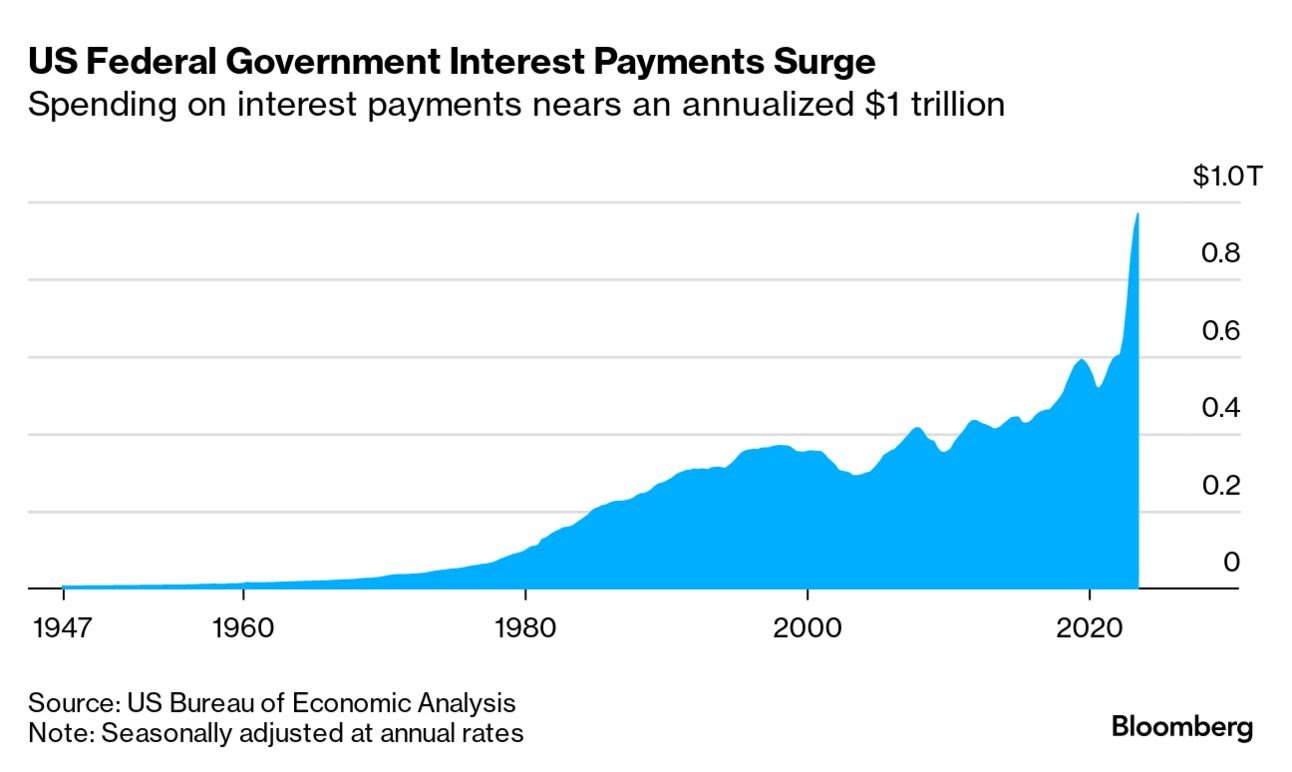

One of the economic trajectories that Fitch did NOT mention was, interestingly, that the cost of servicing all this debt is also rising very quickly. Higher interest rates have consequences for the US government. We must constantly roll over and issue new debt at with far higher interest rate coupons which is causing the cost of all this new debt to sky rocket.

See here:

The lone exception to this tale of woe right now might be economic growth. The US is growing reasonably strongly and shows every expectation of not just continuing but accelerating higher as inflation continues to moderate.

The problem with this sunny outlook is that:

Eventually a recession will come.

When that happens the trajectories of most of these macroeconomic categories will dramatically worsen very quickly.

It is worth pointing out that we have a record low unemployment rate right now and yet are running a massive $1.5 trillion dollar deficit. What will happen to that as well as our debt-to-GDP and debt servicing costs when the recession comes?

Answering that question should be top of mind in Washington, D.C. but it simply isn't right now. If anything, that should focus your mind even more to think carefully and above all prepare for a world where fiscal "business as usual" comes to a stop in this country.

You might be surprised at the answer.....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.