Dealing With Inflation Case Study: Walmart vs Home Depot

We got some specific data - and market reaction - this week when two of the biggest companies and biggest retailers in the US reported their latest earnings.

Both of these emblematic companies - Walmart and Home Depot - thrive selling Americans an endless array of "stuff." They profited immensely during the pandemic but have since struggled to handle the swings of inflation, rapidly shifting demand and the turn away from goods to services.

They are not direct competitors perhaps but are nonetheless engaged in a very similar market and are often taken as very emblematic of how the broader US consumer and economy are performing.

Besides the above significance, we also decided to focus on them not just because their earnings came this past week (Tuesday last before the market opened) but also because both we thought the data truly highlighted the challenge and the opportunities in the economy right now.

For their part, we with many companies across the spectrum, Home Depot is being forced to raise wages to retain staff lowering their revenues and eating into their profits and yet their customers are spending less and less money.

This makes it very difficult for the home improvement giant: they can raise prices to protect their profit margins but that might lead inevitably to just lower sales....

The takeaway is obvious: the home improvement boom is over and Home Depot is uncomfortably confronted with higher costs to run their business but with less demand. Not great.

But this problem isn't actually universal, even in retail.

For instance, it is true that Walmart is also raising wages for similar reasons but they are struggling much less at selling "stuff." As matter of fact, the largest US retailer beat expectations in terms of comparable store sales and it is also growing market share in the grocery store category of its business.

So, speaking very roughly while for the fourth quarter of 2022:

Home Depot = higher costs + lower sales

For Walmart = higher costs + higher sales

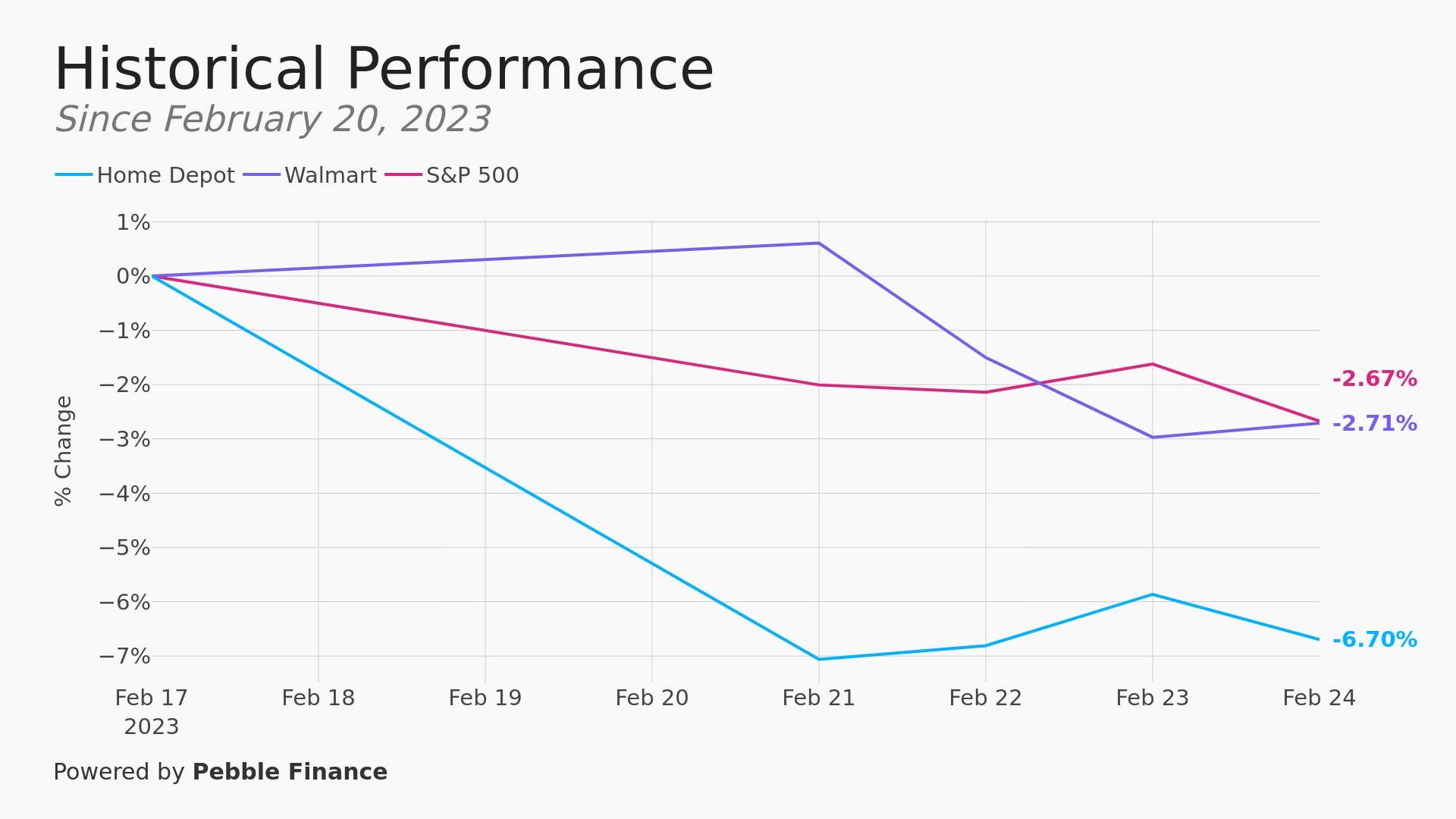

You can see the unsurprising market reaction after their earnings data came out right here:

Home Depot fell by 7%+, meanwhile Walmart rose by nearly 3%.

This underlines the core strength of being in the downmarket grocery business at present. When prices rise, even wealthy Americans go down market trying to make their dollar stretch further. Walmart has been a natural beneficiary of people still needing staples at a price they can afford.

As the meme reminds us, everyone needs to eat.

Now, like most stock analysis it does get more complicated than this. For instance, after years of investment Walmart is finally seeing e-commerce sales and memberships of their Walmart+ online club also grow strongly. They are also making a small but impressively growing amount of money in advertising as well.

But fundamentally, one of these two companies is dealing with the current environment better than the other. The above 1 day performance was sustained over the remainder of the week.

See here:

Walmart roughly tracked the index after their big day while Home Depot fell and kept falling. This graph really stresses us to one of the biggest takeaways from the current environment:

Dispersion.

This is the fact that companies have a diverse performance depending on how well (or not) they are dealing with the current slate of challenges we have outlined above.

Or, in other words, there is a broad range of outcomes when it comes to how companies have dealt with inflation and, in turn, how investors have evaluated that performance.

That will likely continue in the months to come. We are suddenly find ourselves in a classic environment for professional stock picking. If you are both trained and good at picking winners, this could be the time for you provided you can beat the market.

The evidence is that, at least last year, most (~two thirds) active managers were unable to beat the underlying index, even if that index did terribly. Too many active managers were just levering up into high tech growth stocks, it would appear.

But, regardless, if you are not an active manager, this dispersion in returns between companies argues that you should be very, very careful. A rising tide might lift all boats but there is not much of a rising tide right now and in fact, even similar companies are likely to diverge strongly from each other both because of their structural advantages and also, the decisions they make.

So, the tide may be out to head out, not in. Further, that is likely not the only structural issue, as the prices/sales tradeoff for Home Depot demonstrates there are also a host of submerged obstacles, underwater shoals and dangerous currents, all of which could severely damage the returns from even a "safe" large cap stock like Home Depot or Google or IBM etc etc.

Be careful out there and remember to keep an eye on the latest and greatest from the government as well. For that we turn to.....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.