2023 Theme - US Housing - Existing Homes Demonstrate The Stickiness of A Very Frozen Market

We have been getting some useful on the state of the US housing market and why it is in a very precarious place.

The data itself isn't just eye opening, it might also be jaw dropping.

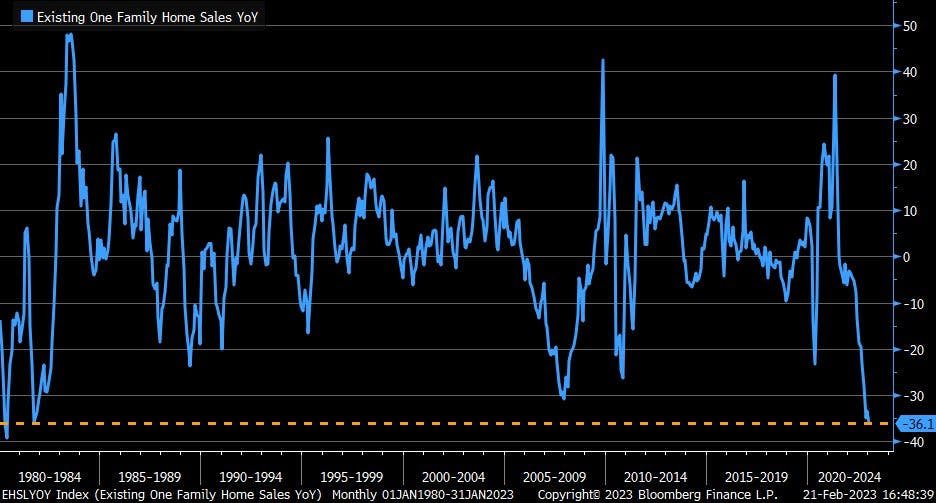

Over the last year to January, single-family existing home sales have plunged 36.1% year-on-year, which is the worst annual drop since May 1980.

See here:

This is a pretty wild chart considering we are NOT in an economic recession and are in fact firmly in an economic expansion.

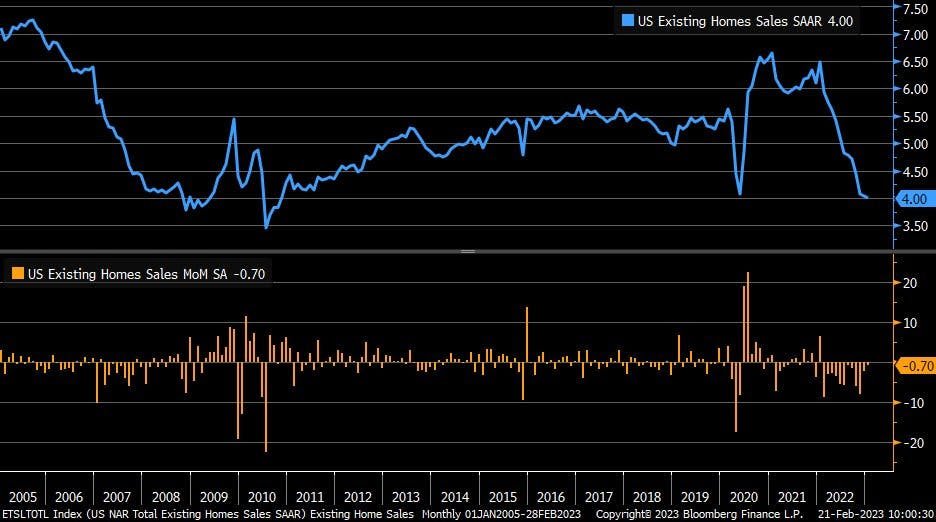

Unsurprisingly, all existing home sales were also terrible. They have now fallen 12 straight months to reach a level not seen since 2010.

See here:

What is particularly impressive is that this means that both December and January figures were lower than May 2020 when the coronavirus pandemic essentially halted the housing market in its tracks.

As we said earlier, remarkable.

Framing the housing market using year-on-year data - which means looking at todays numbers relative to the last calendar year - is a bit foolish, we would admit. After all, part of the reason house prices have fallen so precipitously is the simple fact that the real estate market was incredibly hot in 2021 and very early 2022. This was before we began raising rates of course.

But broadly this data does demonstrate the simple and important fact that very, very few homes are being sold. Twelve straight months of declining sales volume is the longest streak since we began keeping track of housing in the early 1960s. The real estate market is in a bad place.

As regular readers may be aware, we have written on housing already this year and we argued that, essentially, the housing was frozen. Too many people were locked into a very low interest rate on a very long dated mortgage loans and yet would struggle to buy the same amount of house at the new, far higher cost of borrowing for a mortgage.

This made it very hard to entice many homeowners to sell and move when inevitably there was a nasty combination of less available supply AND far higher mortgage rates to contend with.

All of which flowed through to less overall demand. No point in trying to buy if you simply can't afford it.

We are losing sellers unable to trade up and losing buyers unable to afford houses at this price. Hence, frozen.

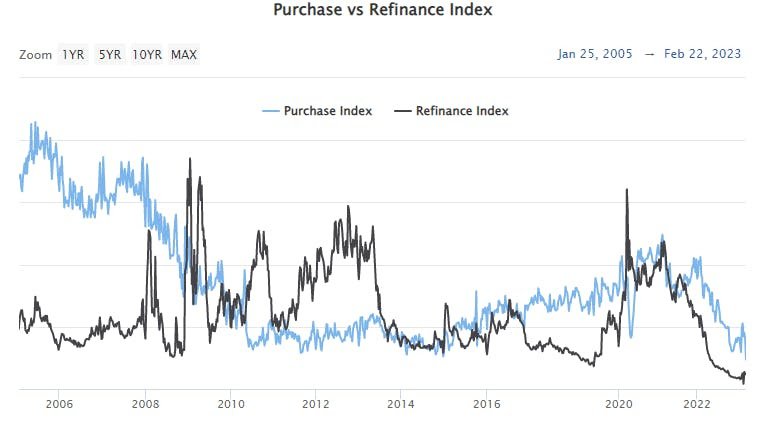

You can see this here in the mortgage applications which are at their lowest level since 1995 regardless of whether you are refinancing an old mortgage loan or new purchases.

Both have plummeted and continue to make new lows, month after month:

Now, we have previously argued that the only possible way out of this situation was lower interest rates which would likely flow through to mortgage rates.

This happened in January as 30 year fixed mortgage rates in the US fell from over 7% to just above 6%. Sure enough, the housing market picked up.

But then, after the strong economic data that we received in February, all of that reversed. Mortgages rates had 3 weeks of gains and are presently hovering in the 6.65-6.75% range. This zig and then zag was nice because it reinforced our point but was also unpleasant in the sense that it demonstrated that this state of affairs may continue for some time.

Another way to put all of this is that housing is very unaffordable right now.

This is backed up by data as well:

(the dotted line is the present day and higher for the lavender line means that the mortgage payment takes up more and more of the homeowner's income).

What this chart reveals is that, when it comes to income and cost of a housing payment, buying a house today hasn't been this unaffordable since the early 1980s. That will be a time well before when most readers of this newsletter were alive.

What to make of all this?

There are a few broad conclusions to draw from this state of affairs:

To generalize somewhat, for the first time in a long time, it is more advantageous to rent rather than own your own home.

As we have argued before, house prices will struggle to appreciate unless mortgage rates come down and this will not happen without a decline in broader interest rates overall.

Further, as we have argued many times, for now, interest are going in the other direction in the US and will do so for at least the foreseeable future.

We are therefore looking at higher interest rates, higher mortgage rates and, if anything, an even less affordable housing market over the short to medium term.

On the big, big question:

"This is nuts, when is the crash?!"

There is lots of speculation that this is exactly what will occur in the US housing market but we don't think so, at least not yet.

Why?

The economy is too strong.

People have long dated loans at low and affordable rates.

Many will be more incentivized to rent out their homes than sell them. There is, after all, a lot of demand for housing just not a lot that can AFFORD the cost of the few homes that are for sale.

Rather than a crash, our expectation is that house prices will continue to slowly come down as the scarce available supply has to adjust to the ever higher mortgage rates but that this occurs very slowly AND very gradually.

We can appreciate that this is a depressing situation for anyone looking to get on the housing ladder or move home, no matter the reason.

Two final reminders:

First, it is important to point out that this state of affairs was the result of policy choices we made willingly. Many of those choices have bipartisan support at the political AND policymaking level.

Second, it is hard not to observe the prevailing trends and come away thinking that the frozen market will likely get chillier still, before experiencing a thaw.

"We chose to ruin one of our most important markets of our own free will" is not a great outcome or a great endorsement of our policymaking apparatus and one that bears thinking about. What could we have done better? Do you think anyone is asking themselves that question - on either side of the aisle i- in DC?

A good time to be a renter but perhaps an even better time to be someone who doesn't have to move. Regrettably that isn't the case with our next section though....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.