An Explanation For The Big US Tech Resurgence

We have covered the current trading environment and the way it could develop a few ways over the last few weeks. For instance we argued that it would be very difficult for bank stocks, especially small banks, to do well in the months and weeks ahead.

But there are some other, larger and more interesting developments we have not covered

What is most notable about this falling volatility/rising stocks tandem?

In short, WHICH companies are rising and also how FEW there are.

So far, we have done well arguing that the bank crisis might not be fatal to the US economy (or even your local bank) but we have done less well in arguing who would profit from these unexpected developments.

It may still be a bad time to be a bank stock but what is it a good time for?

Well, so far this year (and especially the last two weeks) it has been a great time to be a Big Tech company (really any way you want to define Big & Tech).

Here are March returns overall for the S&P 500 scaled to performance. The bigger and greener the square, the better the performance.

File under: things we did not see coming at the start of the month.....

As ever, markets are hard.

And we aren't the only who think so. Here is famous investor Michael Burry making a larger admission the other day:

But it isn't *just* Big Tech strength but also the fact that comparatively and very quietly, the rest of the stock market has done quite poorly.

A few data points:

As of Friday, the combination of Apple, Nvidia, Microsoft, Meta, Tesla, Amazon, Google, Salesforce and AMD have contributed to ~130% of the S&P 500's performance on the year (so the US large company index would be negative for the year without these gigantic companies).

Moreover, Apple, Nvidia, and Microsoft alone have contributed over 80% of the year's (positive) return.

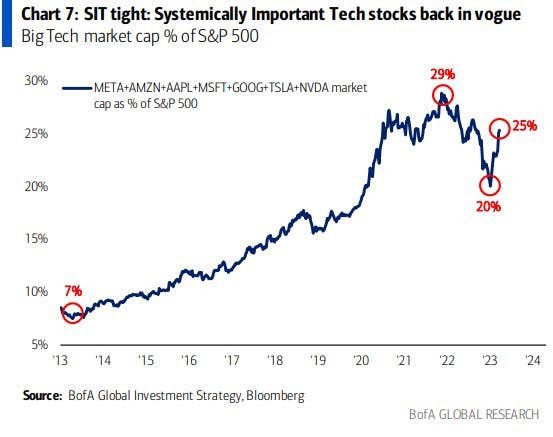

Lastly, FANGAM complex we have derided in the past are back to being over 25% of the S&P 500.

See here from Bank of America:

Wild.

In summary, it has been a very narrow market with only a few companies contributing to the overall index performance.

Once again, the power of indexing makes its case once again.

Another word to describe the current market environment is breadth. There is very little market breadth while it rises. We are experiencing an unusually narrow market.

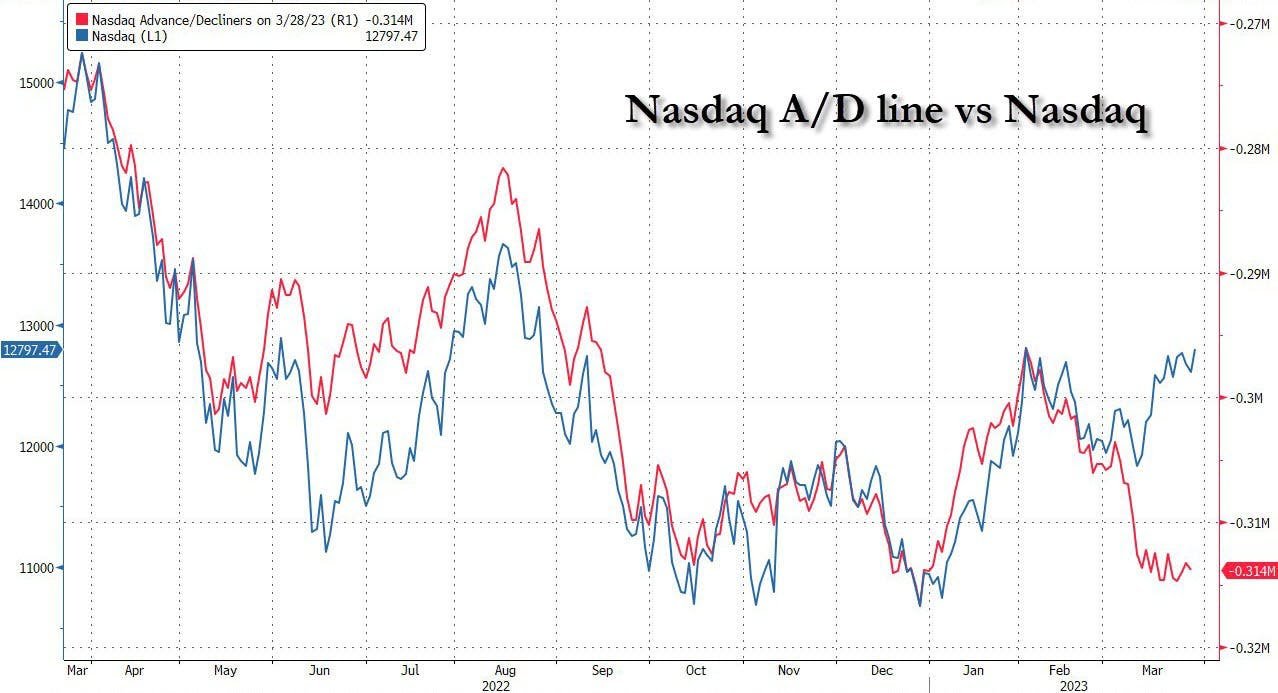

See here:

The blue line is the NASDAQ INDEX while the red line is the number of companies rising or falling. Right now the index is heading higher, while the number of companies that are FALLING outnumber those that are RISING.

That is both surprising for obvious reasons (generally markets don't rise like this consistently) and also notable.

There are two things to conclude here:

The first is that very narrow markets are typically very vulnerable markets.

The second is that, depending on your view of interest rates, this will either likely continue or reverse very quickly.

We have been in the "higher interest rates" and therefore tech underperformance camp for a bit. Clearly we did not anticipate the bank runs and the lower rates that this would bring let alone the rapid Big Tech outperformance that would rapidly follow suit.

This doesn't just make us surprised, it also makes us very cautious.

Why?

Well, because suddenly many investors are betting that low rates and more tech outperformance will return. Essentially, they are investing as if the old regime is back. We are very, very unsure that this will be the case.

Inflation is high, the fear of a credit crunch is receding and, in our opinion, the risk is still that rates head higher, for longer not that suddenly rates will be cut, let alone cut dramatically.

That is people hoping for the world to return as it was, not as it is. Still, we are looking wrong now and could continue to be so going forward.

Either way, we will return to this theme in future weeks and stay honest about our performance here but for now, if you are long any Big Tech companies listed above this is a time to perhaps sell strength and buy some of the assets that have underperformed of late.

Speaking of which.....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.