2024 Theme - The US Deficit Is Going To Matter Again

Here is an easy prediction for 2024:

The US deficit is going to matter.

That is new! For much of the last decade we were told by so-called "experts" that, actually, deficits didn't matter.

Anyway, mattering again means that you are going to hear more and more about it which will be very tiresome.

But steel yourself! Because the fiscal deficit is tiresome AND important.

Mattering also means that sooner rather than later, we are going to be entering an age of reduced spending or austerity.

The simple takeaway is easy: the cost of borrowing isn't cheap anymore.

The thornier implication is harder to predict: we are going to have to make tough choices about where to spend our money.

We have touched on the deficit recently twice but wanted to devote some proper time to exploring what could be one of the bigger themes of the next year.

The reason the deficit is a problem is that, in an era of high interest rates, fiscal policy matters again.

It matters because the US has to borrow at market prices. After the fastest increase in interest rates our borrowing costs are dramatically more expensive than they were even a year ago.

This means the cost of US servicing its debt is going up quickly.

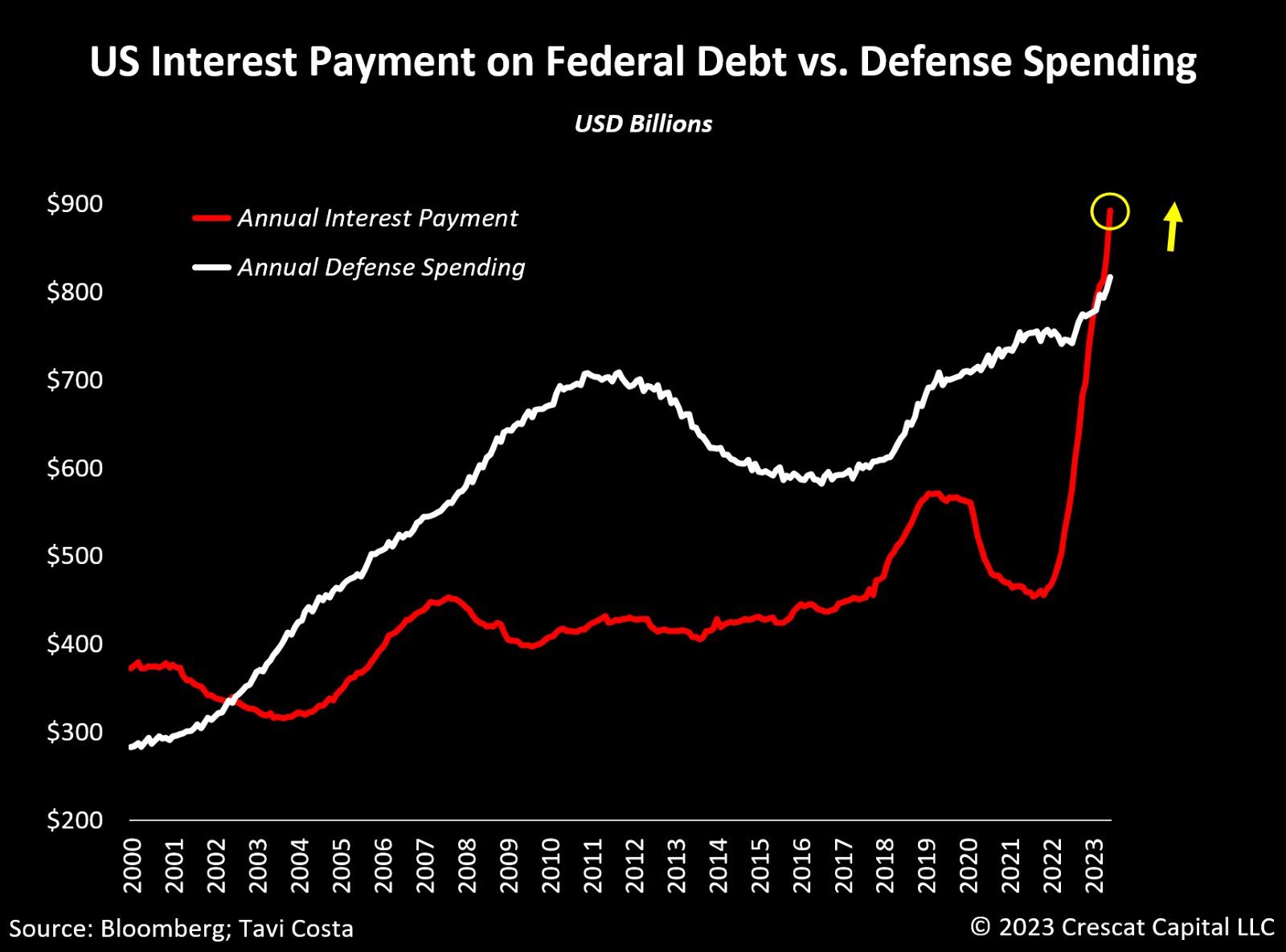

In fact, the US now spends more on paying for its (massive) debt pile than it does on its military. That is a purely arbitrary number but it is also both symbolic and resonant of the tough implications here:

It isn't just that the cost of the debt is going up however. The amount of debt is also exploding.

This is brings us back to the deficit. We have more and more debt because we have a very high deficit.

This chart from Bloomberg has been making the rounds quite a bit:

It shows that, in the end, the US deficit did come in at $2 trillion in the fiscal year that ended in September. As a reminder, the fiscal deficit is how much more the US is spending than taking in in revenues.

That $2 trillion figure is $1 trillion MORE than the sum for the 2022 fiscal year.

This is pretty shocking because, as regular readers know too well, the US economy is doing very well. It is highly unusual to have a sky high deficit when the economy is growing strongly.

And growing it is. We got a US GDP data point this week for the last quarter. It is backwards looking but came in above expectations and showed that the US economy grew 4.9% in the 3rd quarter of the year.

Here is the recent quarter compared to the last 2 years:

So, okay, but what are the implications here?

Well, the easiest implication is that, with inflation staying stubbornly high in the 3-4% range, this means interest rates are not coming down any time soon.

Which in turn will ensure that we are going to rediscover that the deficit matters in 2024 if not before.

As part of that process we are going to re-learn another lesson that we have been able to forget about for a generation:

There is no magic money tree.

In fact, our wealth is a very precious commodity and very finite.

As a direct result of this fact we are going to have to have very tough debates about how we spend our government budget. Our priorities as a society are going to come under the microscope and we will have some very challenging debates around entitlements, around discretionary spending and especially around the cost of servicing the debt.

Debt reduction will be a conversation that follows swiftly on the heels of finding out that deficits do, in fact, matter.

Regardless of how that cookie crumbles precisely, it is also going to mean less spending overall.

We are entering an age of austerity.

This new age may not happen immediately in 2024 for political reasons. Or more precisely because of the political calendar. 2024 is of course a big election year here in the US.

But it will happen sooner rather than later and less government spending will hinder the US economy. One of the biggest drivers of the strong GDP number in the third quarter was, you guessed it, government spending.

The immediate challenge is that both sides of the political spectrum have been able to ignore any need for fiscal restraint.

It will be interesting to see who gets the new religion first. Regardless of which politician or which party comes around to the new reality the fastest, there will be other parts of the budget that cry out for more spending and an enhanced role.

We are pretty sure most of our readers won't love this new spending priority. It is a tough subject at the best of times and this era is increasingly very far from the best of times.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.