2022 Theme: US Inflation - Used Car Prices Fall Steadily

The second piece of evidence that we could be at peak (or past peak) inflation comes from used car prices.

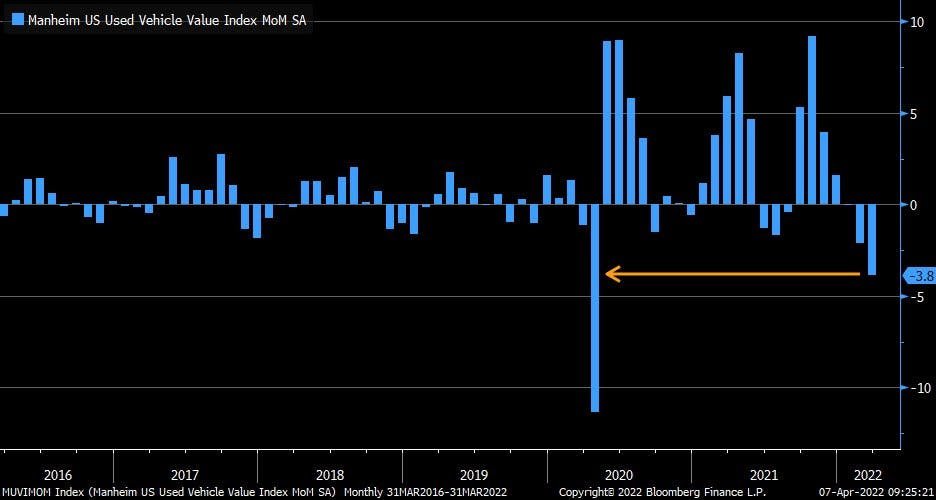

The Manheim used car index came out this week and registered a very (for it) steep fall of 3.8%.

This actually makes the second month in a row of straight declines (Feb was -2.1%). And the steepest since April of 2020, during the peak of the early (and scary) pandemic.

This is great news for car buyers everywhere and will hopefully continue. It also indicates that - slowly - the incredible demand for new and used vehicles is beginning to clear.

That demand has been completely historic. For context, typically no one pays over the sticker price for a car. In January, over 82% of car buyers did exactly that. Many of them paying 10-20% more and some as much as 40-50% above retail asking price.

This is clearly abnormal.

It also suggests that we are not entering a economic downturn. This is another data point that doesn't suggests that inflationary pressures could be easing as months and months of record demand begins to ebb.

Everyone can't buy a new car every year. Not even car crazy Americans are that crazy.

This could be very welcome news. Used car prices made an outsized contribution to the exceptionally high CPI inflation last year. This year we could start seeing the opposite effect.

That would be welcome and not just for car buyers. Central bankers and especially Jay Powell will be thrilled at this headline.

Now we just need the Fed to...raise rates to fight the poor wheat harvest?!?!

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.