2022 Theme: Housing - US Demand For Homes Cools In Face Of Rate Hikes

Since the inception of this newsletter, we have periodically written on the US housing market and how it is an excellent representation of the financial challenges and monetary excesses profoundly affecting the US economy (and society).

It is also a pretty good barometer for how the efforts to improve matters is progressing.

Housing makes a nice symbol and an even better weathervane.

We last formally discussed the sector in early April when we wrote:

"At 5% (and rising!) mortgage costs could finally begin seriously dampening the red hot housing market. What was affordable at 3% or 4% will start to become hard at 5% or 6%."

This week, we got some new data on the US housing market that reinforced the above thesis and also helpfully provided some data around the health of the US economy.

******

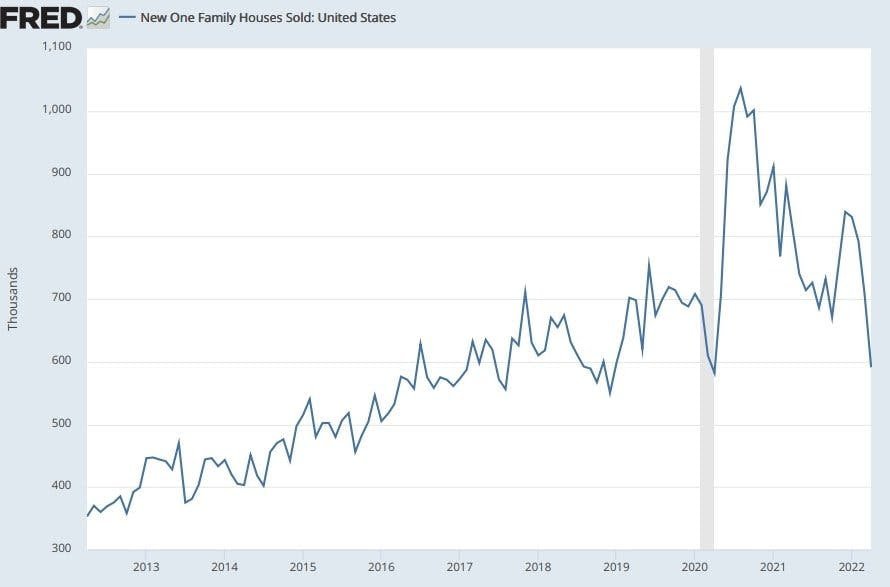

The short of it is that US new home sales came out this week and did so with a thud. They collapsed by 16.6% to 591K, the lowest since April 2020 or since the pandemic began.

This data release can be a bit volatile but the number was still a shock and indicated that - surprise, surprise - the fastest rise in mortgage rates ever would have a pretty swift impact on housing demand:

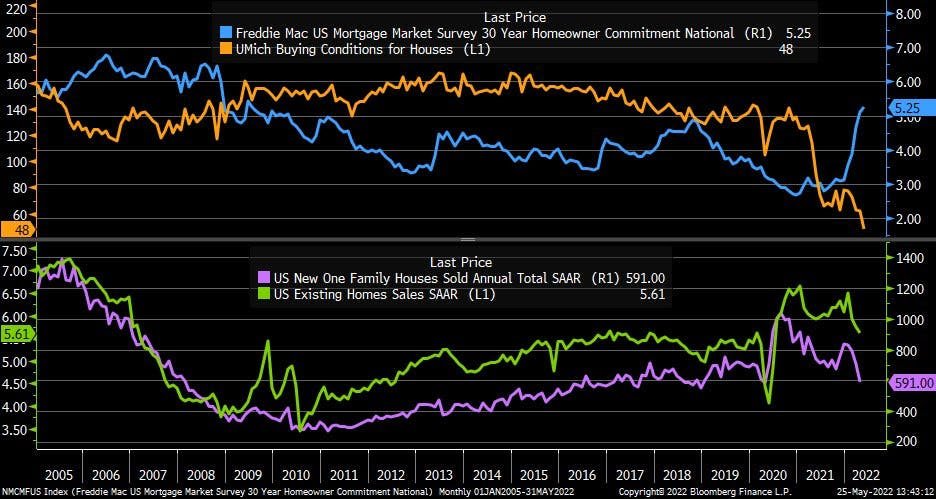

There is no denying that the collapse has been swift. From just over 3% at the start of the year to over 5.30% this month, the current US fixed 30 year mortgage has actually fallen the last two weeks but still remains well above 5%.

You can see the impact clearly in this graph. Blue line (mortgage rates) up rapidly, orange line down (buying conditions) which rapidly feed into both new and existing home sales (green and purple):

Two further point on this development:

This disappointing new homes data instantaneously created a lot of speculation that, yes, a recession was in the offing and furthermore, that this could come with a dramatic collapse in the housing market.

And this decline in activity also suggested that, well, raising interest rates swiftly can achieve at least some of the impact that we require to cool down the economy and stop a 1970s-like inflationary cycle from taking hold.

Quite a shift! From the hottest housing market ever at the start of the year to "Winter Is Coming"-type sentiment by Memorial Day. Let us examine each argument in turn.

On the first point, this strikes us as a bit hyperbolic. Housing demand has struggled largely thanks to the dramatic increase in the cost borrowing. But that doesn't mean housing market is falling off a cliff and for evidence of that look no further than the fact that house prices are actually hanging in there.

In fact, they continue to rise with the average home now costing over $450K for the first time ever.

And therein lies the rub. With supply still so constrained and plenty of pent up demand you can have a sharp fall in the latter but still not see any follow through in terms of prices.

Now, yes, over time house prices will also likely start to come down. In fact, they might already be doing so. That is not just expected but also very welcome? As with stocks and many other assets, housing has had an incredible two years and a pause or even slight decline will not necessarily lead to a complete collapse.

Building on this theme and also referencing the second point above, the ability of interest rates to impact mortgage demand and existing home sales could be a good thing!

After all, we desperately need to get the housing market under control or increasing numbers of middle class Americans will be priced out of ever owning their own home.

Home prices coming back to earth and also becoming more normal could be a great thing. If you expect 30%+ increases in house prices every year then you are either greedy or crazy or both.

The added benefit might also be that higher costs and higher rates with less potential appreciation might also deter some of the professional buy-to-let (i.e.: rent) operations that have been built up quickly in the era of ultra low rates. A little less professionalization of the retail housing market could be a great thing for many regular, aspirational home owning Americans.

We have written on the gradual takeover of the housing market by professional investors before as well. It is an important theme to think about when the Fed slashes rates (and buys mortgage bonds via their quantitative easing program).

It is important to keep in mind that there are negative incentives as well as positives for the economy.

It is one thing to be in competition with your classmates and peers for a rung on the housing ladder. It is another whole other ball game when you are competing with a private equity firm or pension fund.

In the end, we may still have a difficult time securing the "soft landing" that Chair Jay Powell is aiming for but the first steps towards doing so are not irrefutable proof of our collective doom.

Rather than an incipient recession, many or all of these developments could be simply signs of market returning to normalcy.

Better put: 2022 isn't weird. 2021 was weird.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.